ARTICLES

Explore our latest insights on the beauty, luxury, and lifestyle industries. At Carrara Advisory, we combine decades of hands-on experience with deep market understanding to provide actionable perspectives on strategy, innovation, and growth. Here, we share our thinking on the trends, challenges, and opportunities shaping the future of your business.

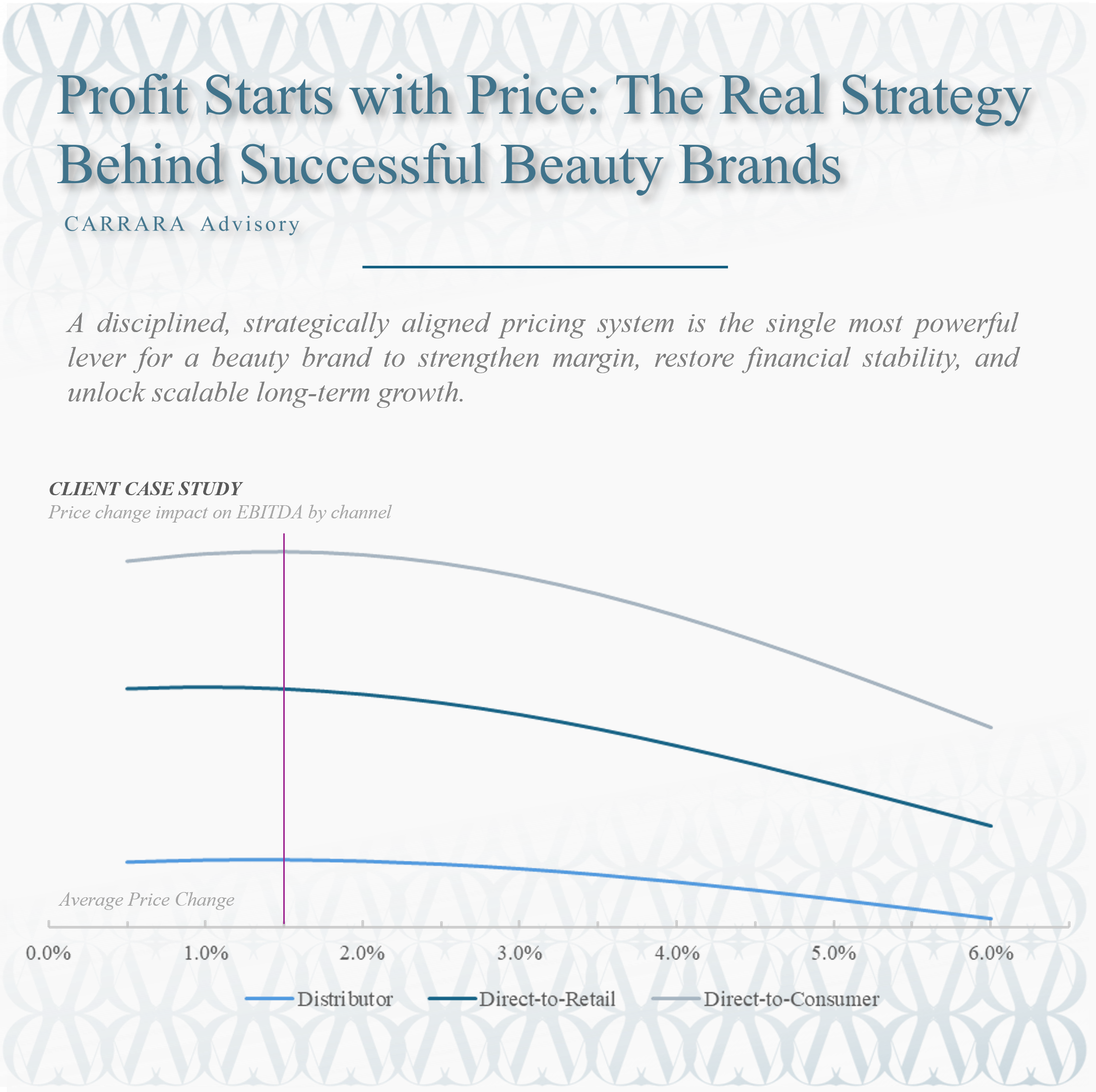

Profit Starts with Price: The Real Strategy Behind Successful Beauty Brands

A disciplined, strategically aligned pricing system is the single most powerful lever for a beauty brand to strengthen margin, restore financial stability, and unlock scalable long-term growth.

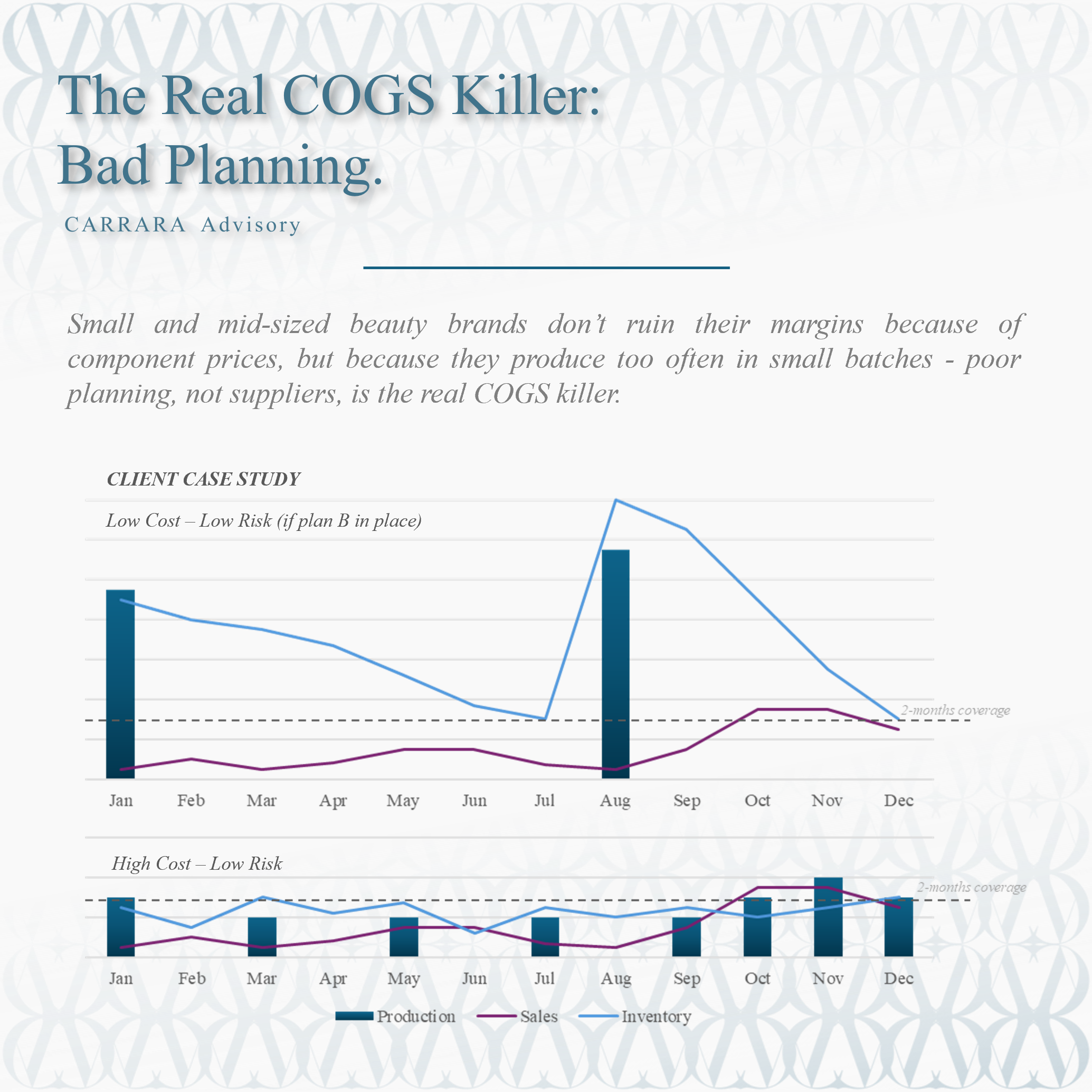

The Real COGS Killer: Bad Planning.

Small and mid-sized beauty brands don’t ruin their margins because of component prices, but because they produce too often in small batches - poor planning, not suppliers, is the real COGS killer.

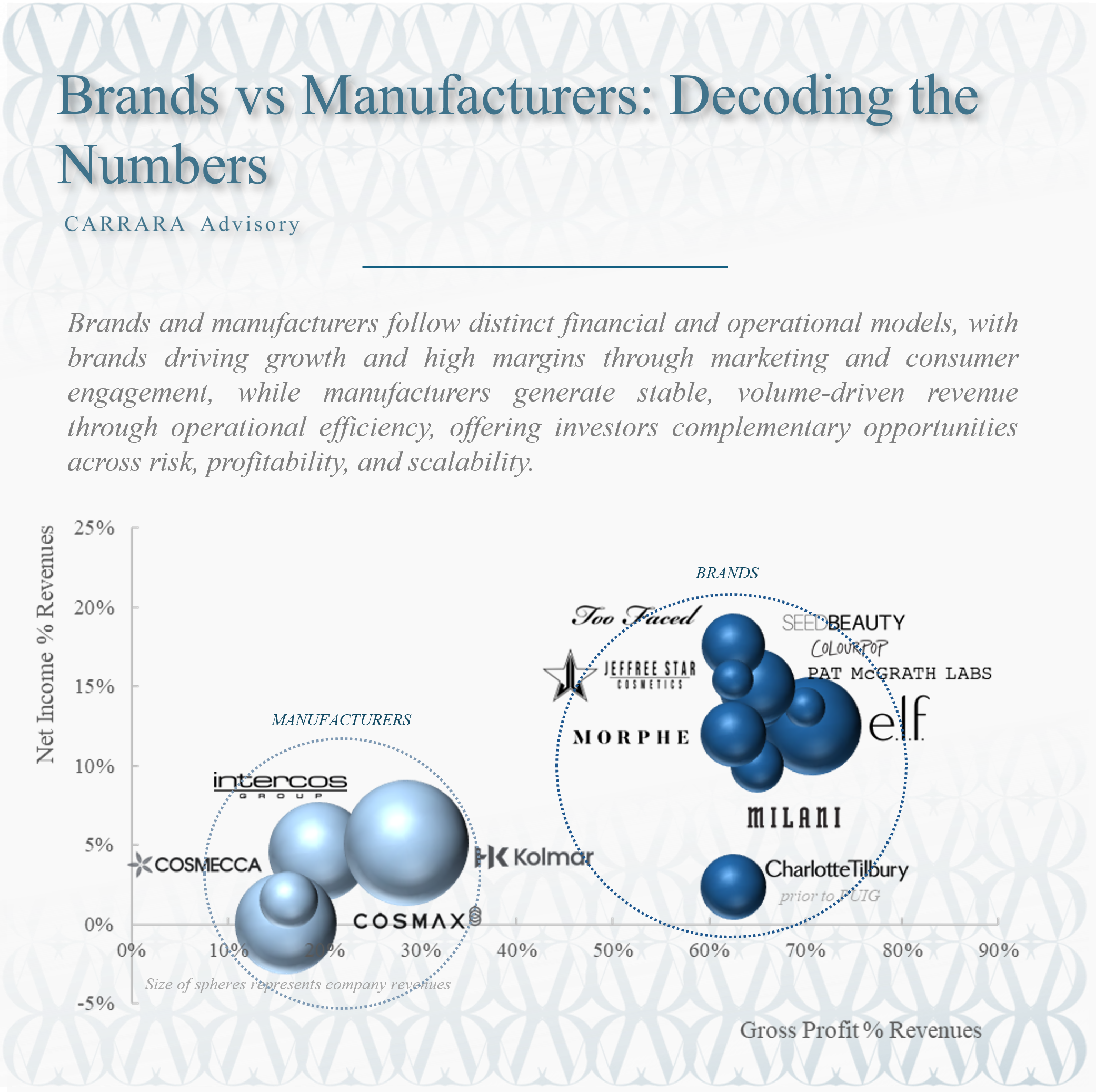

Brands vs Manufacturers: Decoding the Numbers

Brands and manufacturers follow distinct financial and operational models, with brands driving growth and high margins through marketing and consumer engagement, while manufacturers generate stable, volume-driven revenue through operational efficiency, offering investors complementary opportunities across risk, profitability, and scalability.

Inflation Resilience. Two Decades of Industry Winners and Losers

Over twenty years, industries differ sharply in their ability to outpace inflation, with brand-driven, emotionally valued, and innovation-led sectors like beauty, jewelry, apparel, and IT showing consistent real growth, while cyclical, regulated, or discretionary categories such as automotive, alcohol, and parts of pharma often underperform.

From H1 Struggles to Q3 Growth: Key Trends Shaping the Beauty Industry

A clear recovery, with growth driven by agile, innovation-focused brands, strategic turnarounds, and strong execution across channels and regions, while legacy mass-market segments continue to face pressure.

Performance: The Financial Backbone of Kering’s Transformation

Kering’s financial performance over the past two decades reflects the payoff, and limits, of its luxury-focused strategy, showing how margin expansion, working capital evolution, and leverage dynamics shaped the group’s profitability and balance sheet strength.

In-House vs Licensing: Strategic Choices and the Cost of Control

While licensing offers a low-risk, capital-light entry and in-house delivers greater control, profitability, and long-term brand equity, the most effective path is not fixed but depends on each brand’s context.

Proya Group: The Blueprint of China’s Rising Beauty Empires

Proya Group’s rise from a local Chinese skincare brand to a digitally-driven, multi-brand powerhouse exemplifies how China’s new beauty empires combine data-driven insight, agile brand management, and strategic sequencing to scale domestically and prepare for global expansion.

Private Equity is Shaping the Next Generation of CDMOs - 1Q Health Case

The beauty and wellness industries are converging, driving rapid growth, and pushing traditional CMOs further evolve into full-service CDMOs offering end-to-end solutions from formulation to brand support. Private equity is now shaping this space by building next-generation platforms that combine speed, scientific credibility, and integrated services to meet the rising demand.

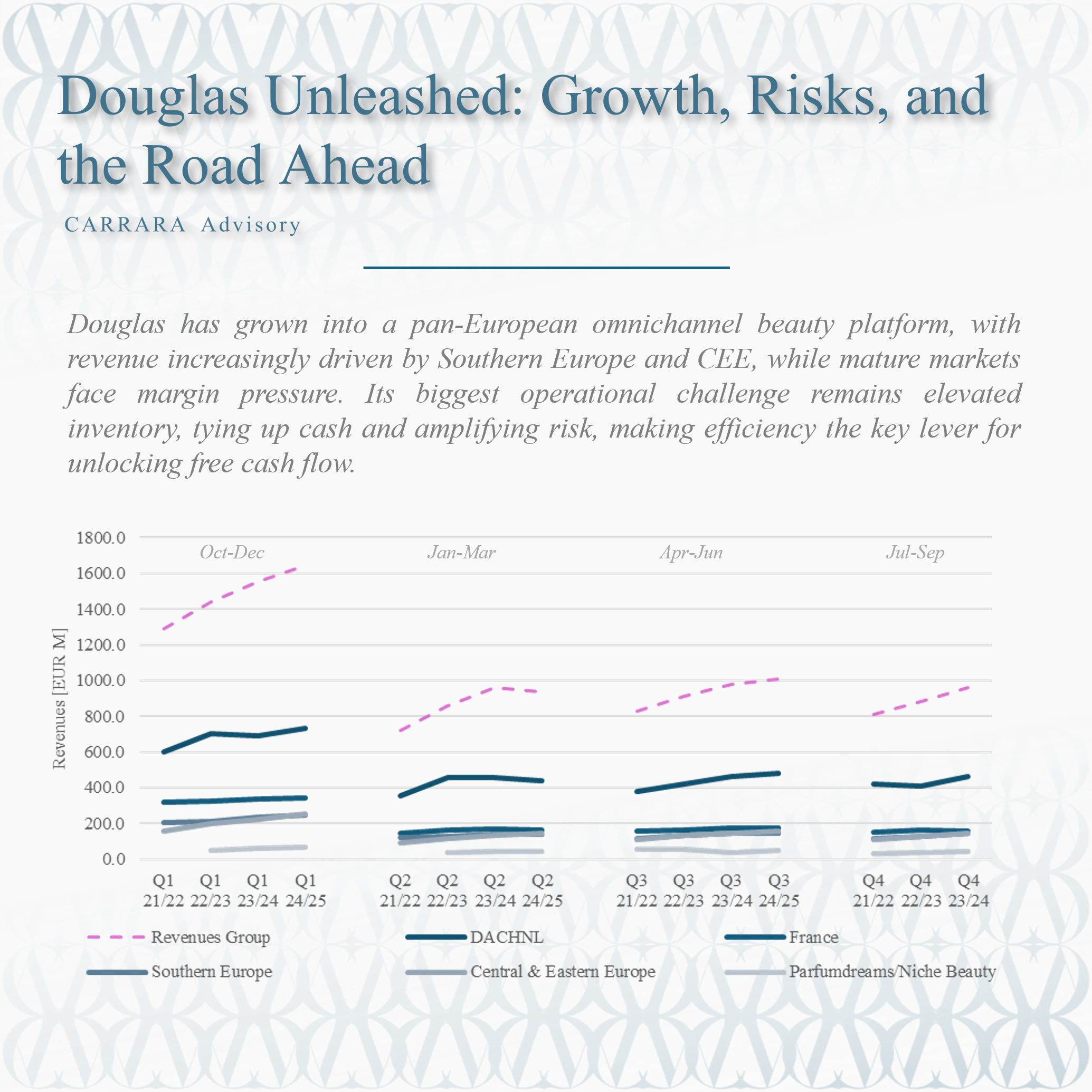

Douglas Unleashed: Revenue, Risk, and the Road to a Balanced Future

Douglas has grown into a pan-European omnichannel beauty platform, with revenue increasingly driven by Southern Europe and CEE, while mature markets face margin pressure. Its biggest operational challenge remains elevated inventory, tying up cash and amplifying risk, making efficiency the key lever for unlocking free cash flow.

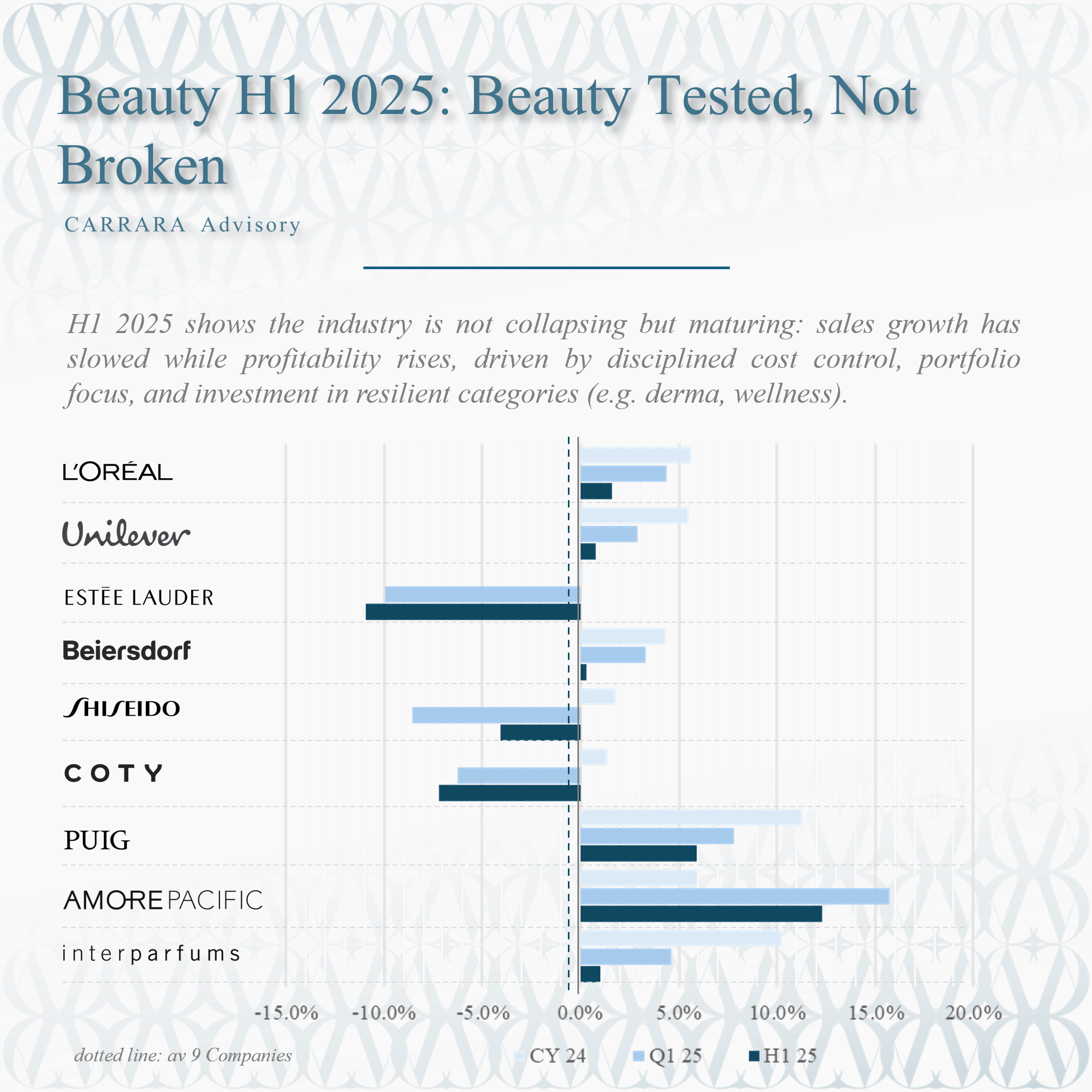

H1 2025 Beauty Tested, Not Broken

H1 2025 shows the industry is not collapsing but maturing: sales growth has slowed while profitability rises, driven by disciplined cost control, portfolio focus, and investment in resilient categories (e.g. derma, wellness).

Intercos: The Unseen Force Powering the World’s Biggest Beauty Brands

Intercos doesn’t sell to consumers, yet it shapes what millions apply daily. With strategic acquisitions, a “glocal” footprint, and a laser focus on R&D, Intercos has gone from Milan startup to global force powering most of the world’s top 30 beauty brands and hitting €1B+ revenues despite major disruptions.

Medik8: From Pangea Laboratories to a Skincare Powerhouse – The Story of Growth and Transformation

While all eyes are on the Rhode x e.l.f. deal, L’Oréal’s rumored €1B acquisition of Medik8 raises eyebrows - impressive growth, yes, but at a valuation at 7.8x revenues and 23.2x EBITDA looks quite stretched… unless we miss something!

Growth Slows, Costs Rise: The Beauty Industry’s Next Great Challenge

The beauty industry demonstrated resilience in 2024 but faces slower growth in 2025, with success relying on agility, technology investment, and navigating economic and regulatory challenges.

Location Matters: How Corporate and Personal Taxes Shape LLC’s Financials

Choosing the right LLC jurisdiction is instrumental for optimizing the Net Personal Income / Revenue Ratio, minimize tax burdens and maximize personal income. Switzerland emerges as the most favourable option.

The Resilient Beauty Industry: Key Takeaways from CY 2024

The beauty industry demonstrated resilience amidst challenges, with agile companies leading growth, while major players maintained steady performance despite headwinds.

How Much It Really Costs to Launch a Beauty Brand

Launching a successful beauty brand to $5M in revenue within two years requires an investment of $3M to $8M, depending on the category (skincare, makeup, or fragrance) and key factors like brand positioning, formulation complexity, marketing strategy, and distribution model.

European Beauty Retailers: A Deep Dive into Market Dynamics

How do Europe’s top beauty retailers balance store count and profitability? While giants like DM and Rossmann scale through extensive networks, smaller players such as Notino and Sephora excel with targeted strategies, showcasing the growing importance of e-commerce, sustainability, and experiential retail in driving store productivity.

From Design to Price: How Watch Brands Shape Their Value

The pricing strategies of luxury watch brands are as intricate as the timepieces themselves. From brands like Rolex and Cartier focusing on incremental growth to the steep price escalations of Lange & Söhne and Jacob & Co., each adopts a unique approach reflecting their design, costs, and positioning.

Cash is King, but it Doesn't Rule Alone!

Cash is crucial for the smooth operation of a business. However, cash alone provides limited insight into a company's overall financial health.