ARTICLES

Explore our latest insights on the beauty, luxury, and lifestyle industries. At Carrara Advisory, we combine decades of hands-on experience with deep market understanding to provide actionable perspectives on strategy, innovation, and growth. Here, we share our thinking on the trends, challenges, and opportunities shaping the future of your business.

The Retailer Taking the European Landscape by Storm: Action!

Action has transformed from a single Dutch discount store in 1993 into Europe’s fastest-growing non-food retailer, now spanning over 3,000 stores and €13.8 billion in revenue by 2024. Its unique mix of low prices, operational excellence, and a “treasure hunt” shopping experience has fueled both rapid expansion and rising store productivity - a rare feat in value retail

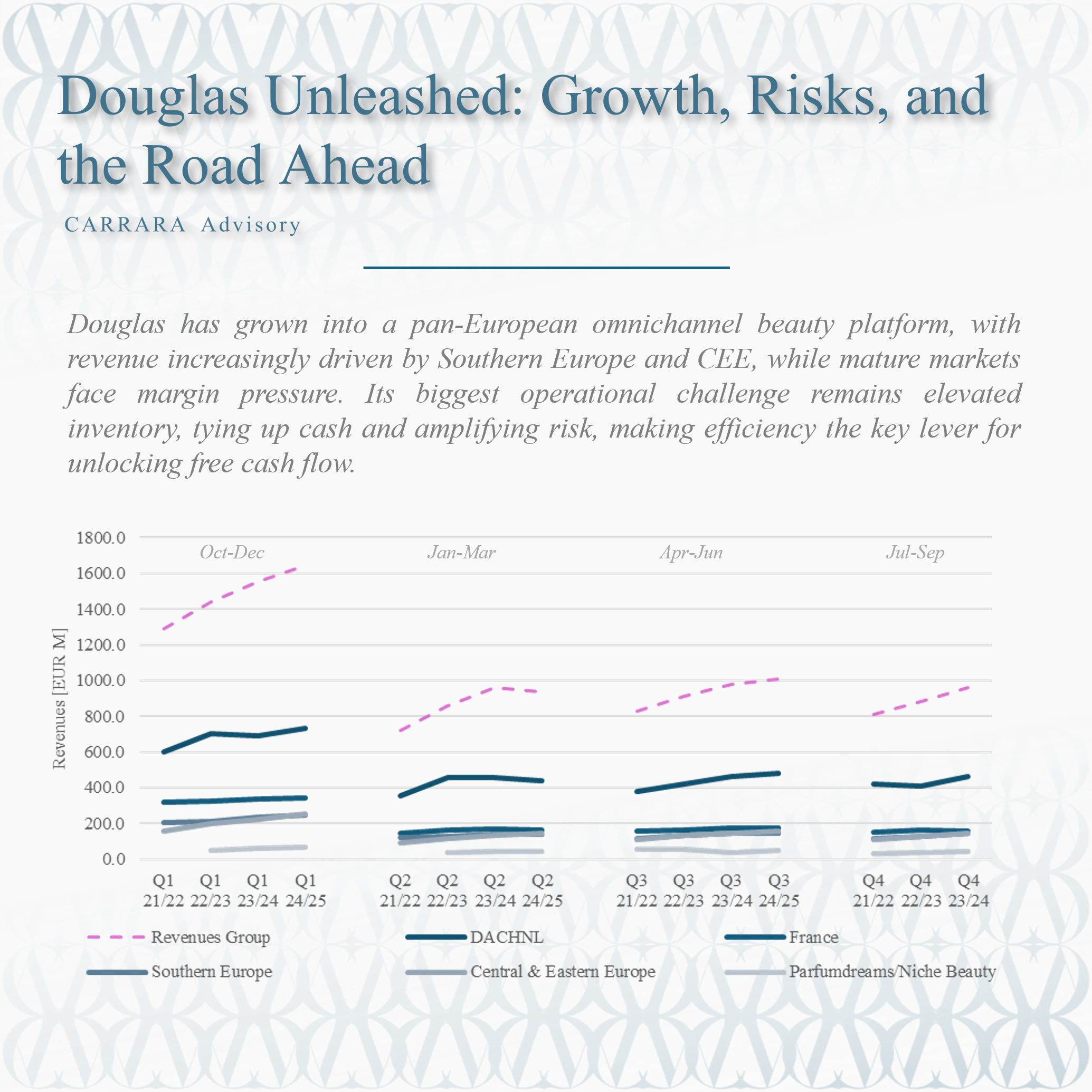

Douglas Unleashed: Revenue, Risk, and the Road to a Balanced Future

Douglas has grown into a pan-European omnichannel beauty platform, with revenue increasingly driven by Southern Europe and CEE, while mature markets face margin pressure. Its biggest operational challenge remains elevated inventory, tying up cash and amplifying risk, making efficiency the key lever for unlocking free cash flow.

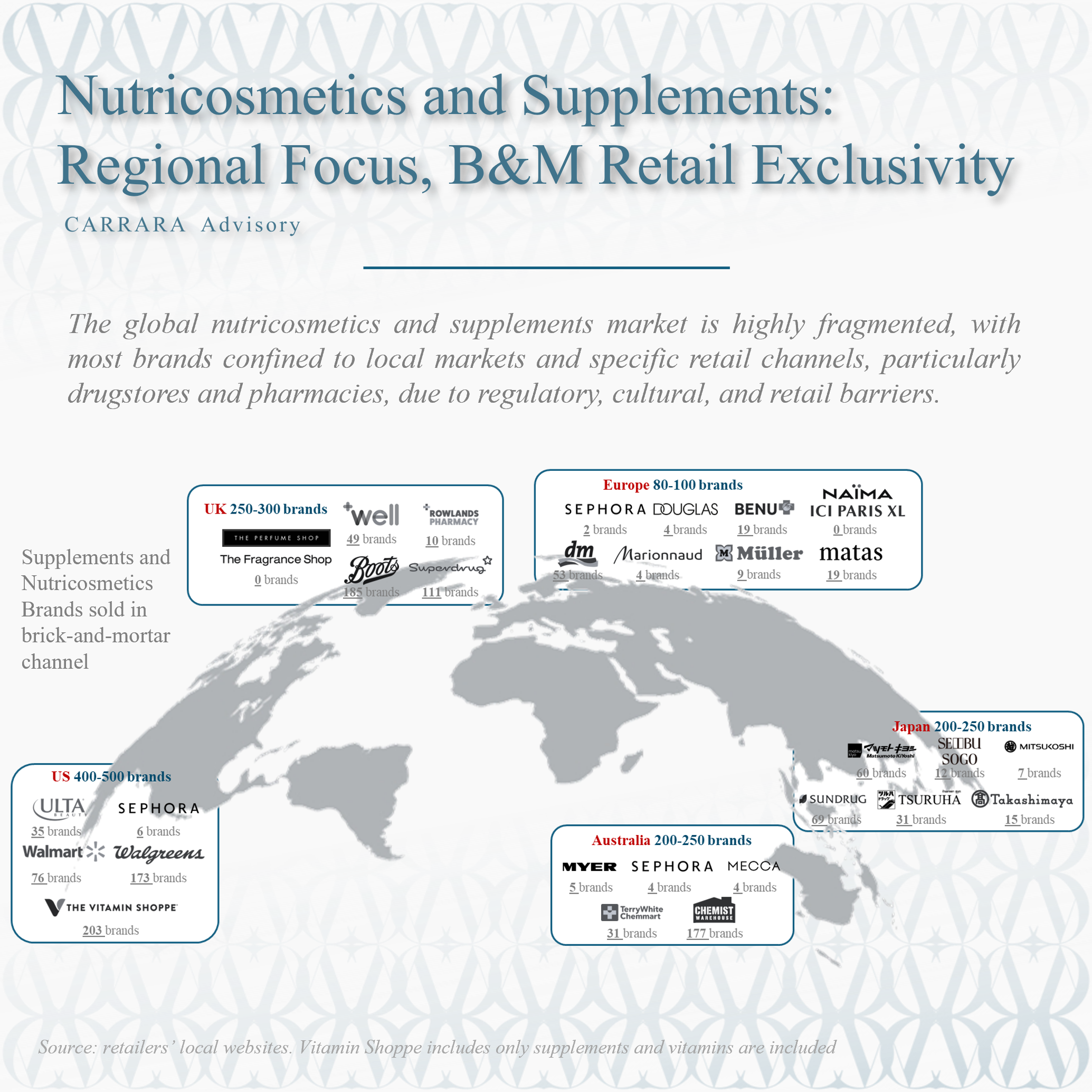

Nutricosmetics and Supplements: Regional Focus, B&M Retail Exclusivity

The global nutricosmetics and supplements market is highly fragmented, with most brands confined to local markets and specific retail channels, particularly drugstores and pharmacies, due to regulatory, cultural, and retail barriers.

The Middle East: A $60 Billion Opportunity for Beauty Brands

The Middle East, a region rich in history and culture, is a rapidly growing market for the beauty industry, valued at over $46 billion and driven by rising disposable incomes, urbanization, and a young, tech-savvy population. Brands looking to succeed must navigate cultural nuances, regulatory requirements, and diverse distribution channels, while leveraging digital platforms to connect with consumers.

European Beauty Retailers: A Deep Dive into Market Dynamics

How do Europe’s top beauty retailers balance store count and profitability? While giants like DM and Rossmann scale through extensive networks, smaller players such as Notino and Sephora excel with targeted strategies, showcasing the growing importance of e-commerce, sustainability, and experiential retail in driving store productivity.

Sephora vs. Ulta: A Tale of Two Assortment Strategies in the Makeup Category

Ulta’s broader assortment reflects its approach as a masstige retailer, catering to a diverse customer base across various price points. Sephora’s focus on curating a more premium and luxury-focused selection allows them to offer a deeper range for high-end brands