Leverage further differentiates the two models. E.L.F. Beauty maintains conservative debt levels relative to EBITDA, reinforcing financial flexibility and reducing risk. This allows the brand to fund aggressive marketing campaigns, expand distribution, and pursue strategic acquisitions without compromising liquidity. Intercos, while also maintaining reasonable leverage, operates in a capital-intensive environment where production facilities, equipment, and R&D investments are substantial. The company must balance borrowing with operational cash flow to finance these fixed assets while sustaining service levels for multiple clients. This operational leverage amplifies the importance of consistent revenue streams and efficient cost control, as even small inefficiencies can impact margins more significantly than in a brand-driven model.

In summary, the financial structures and operational choices of makeup brands and manufacturers reflect their distinct business strategies. Brands like E.L.F. Beauty allocate significant resources to marketing, consumer engagement, and growth initiatives, managing working capital to balance inventory and receivable timing with market responsiveness. This approach enables higher margins and strong growth potential, albeit with greater exposure to market trends and operational execution risks. Manufacturers like Intercos, in contrast, focus on operational efficiency, large-scale production, and leveraging client relationships and supplier terms to generate stable cash flow. Their lower margins are offset by consistent revenue and resilience built through scale and diversified clients. Understanding these differences is essential for investors, as each model presents unique opportunities, risks, and financial imperatives: brands offer growth and profitability upside, while manufacturers provide stability and operational leverage, together representing the full spectrum of strategic investment options within the makeup sector.

Strategic Implications for Investors

Investors must carefully weigh the trade-offs between makeup brands and manufacturers, as each presents distinct financial dynamics and strategic opportunities. Brands, such as E.L.F. Beauty, offer the potential for high-margin growth, strong consumer loyalty, and scalability, but they also carry higher exposure to market trends, marketing costs, and inventory risks. Manufacturers, like Intercos, provide stable, diversified revenue streams, operational leverage, and resilience through scale, though they operate on lower margins and face competitive pressures that can limit upside.

For equity investors, a balanced approach may be particularly effective. Exposure to both brands and manufacturers captures the high-growth, high-margin potential of brands while benefiting from the predictable, volume-driven stability of manufacturers. Private equity and strategic investors may find opportunity in manufacturers with strong R&D capabilities, a global footprint, and long-term client relationships, while brand founders should focus on selecting manufacturing partners who are not only operationally reliable but also innovative collaborators. For manufacturers, continued investment in technology, operational efficiency, and sustainability is essential to differentiate in a competitive landscape and support evolving brand needs.

Key Takeaways

The industry presents two complementary but distinct pathways for value creation. Brands leverage marketing, innovation, and consumer engagement to achieve high margins and scale, converting investment in growth initiatives into profitability. Manufacturers focus on operational efficiency, volume, and diversified client relationships to generate stable revenue and consistent cash flow, even with lower margins.

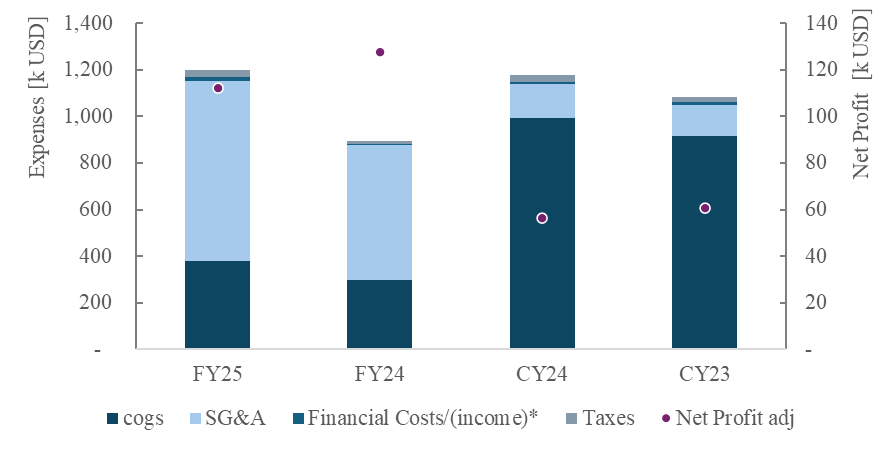

A deep understanding of financial mechanics, cost allocation, and working capital management is critical for investors. Brands allocate more to SG&A and marketing, maintaining flexibility to drive growth, while manufacturers invest heavily in production and optimize inventory, receivables, and payables to sustain operations at scale. Both models come with unique risks and opportunities, and each offers a different risk-reward profile depending on investor objectives.