ARTICLES

Explore our latest insights on the beauty, luxury, and lifestyle industries. At Carrara Advisory, we combine decades of hands-on experience with deep market understanding to provide actionable perspectives on strategy, innovation, and growth. Here, we share our thinking on the trends, challenges, and opportunities shaping the future of your business.

The Great Beauty Portfolio Reset - When Divestiture Becomes the Growth Strategy

The beauty industry is undergoing a structural reset in which large groups like Estée Lauder and Coty are divesting mid-tier, makeup-heavy, marketing-dependent brands that no longer fit their economic and strategic models, signalling a broader shift toward smaller, more focused portfolios built around brands with clear positioning, defensibility, and sustainable growth.

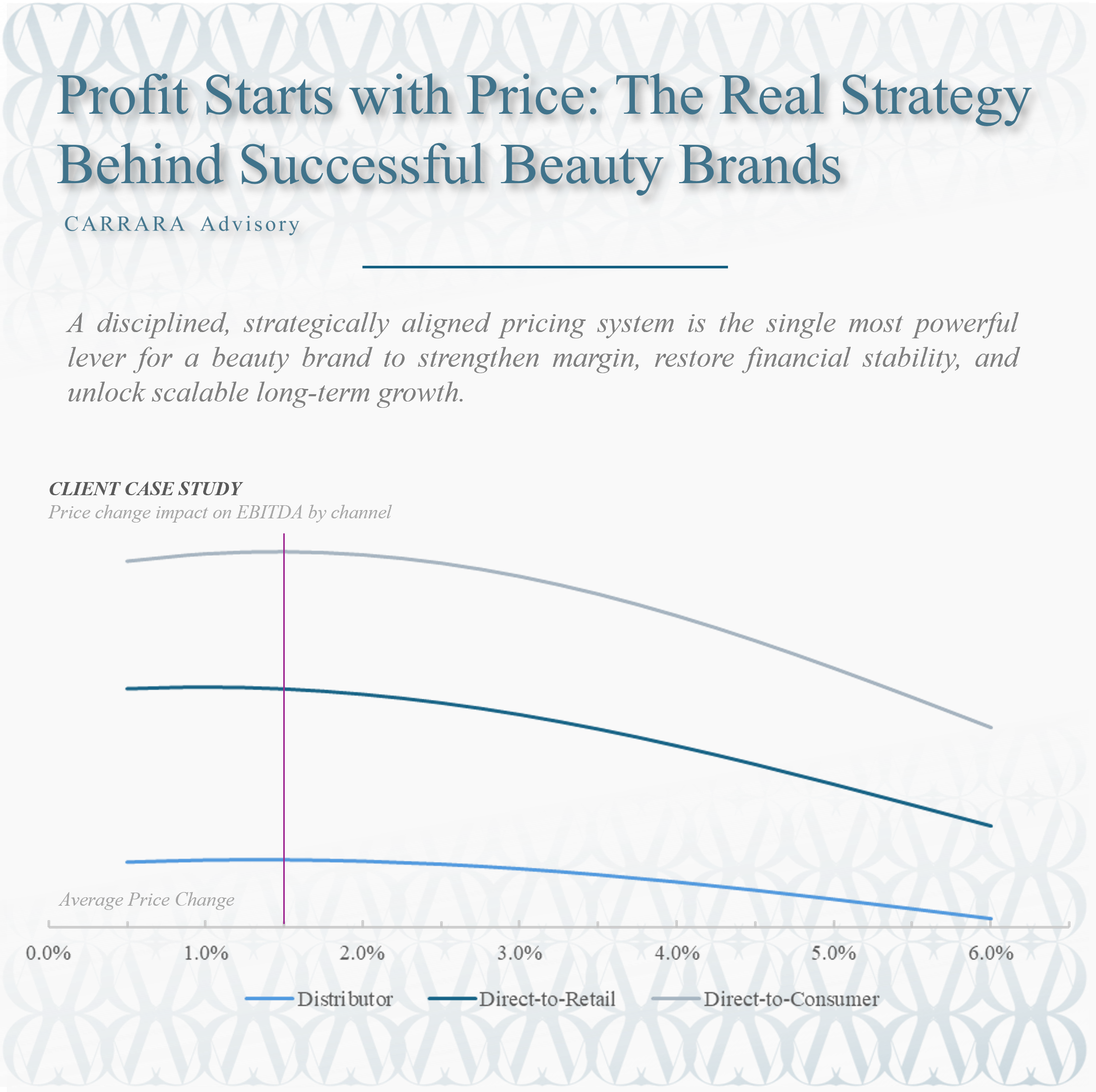

Profit Starts with Price: The Real Strategy Behind Successful Beauty Brands

A disciplined, strategically aligned pricing system is the single most powerful lever for a beauty brand to strengthen margin, restore financial stability, and unlock scalable long-term growth.

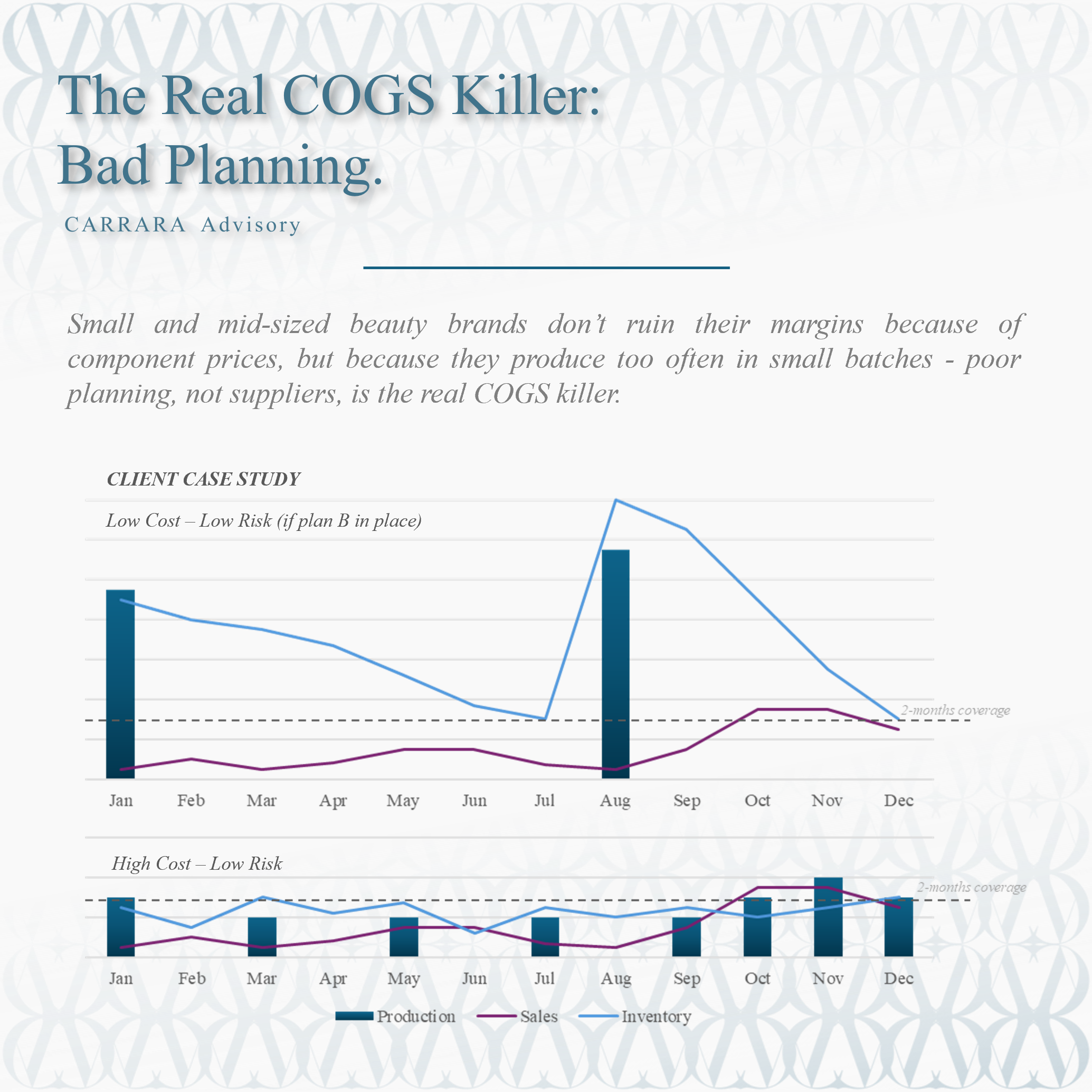

The Real COGS Killer: Bad Planning.

Small and mid-sized beauty brands don’t ruin their margins because of component prices, but because they produce too often in small batches - poor planning, not suppliers, is the real COGS killer.

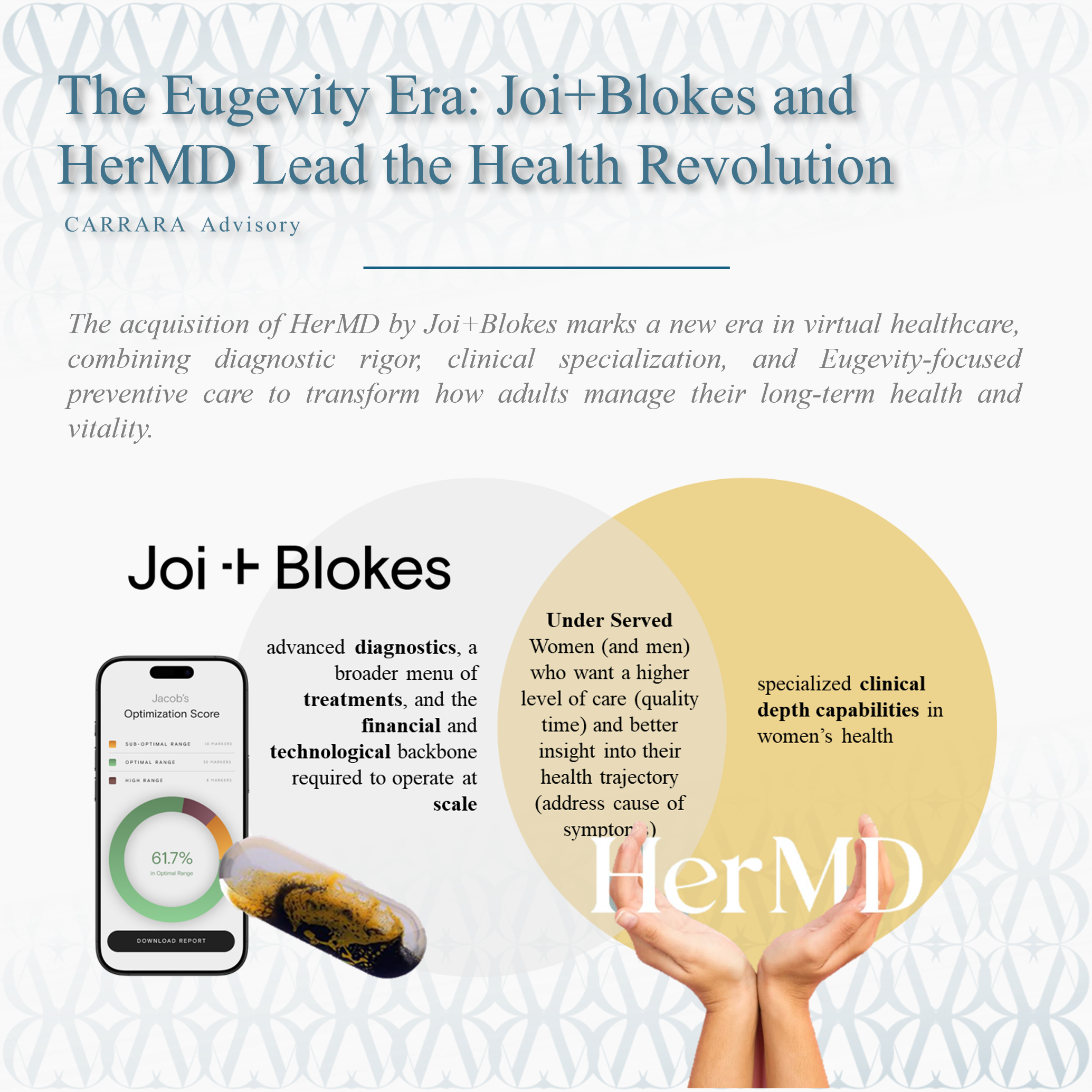

The Eugevity Era: Joi+Blokes and HerMD Lead the Health Revolution

The acquisition of HerMD by Joi+Blokes marks a new era in virtual healthcare, combining diagnostic rigor, clinical specialization, and Eugevity‑focused preventive care to transform how adults manage their long-term health and vitality.

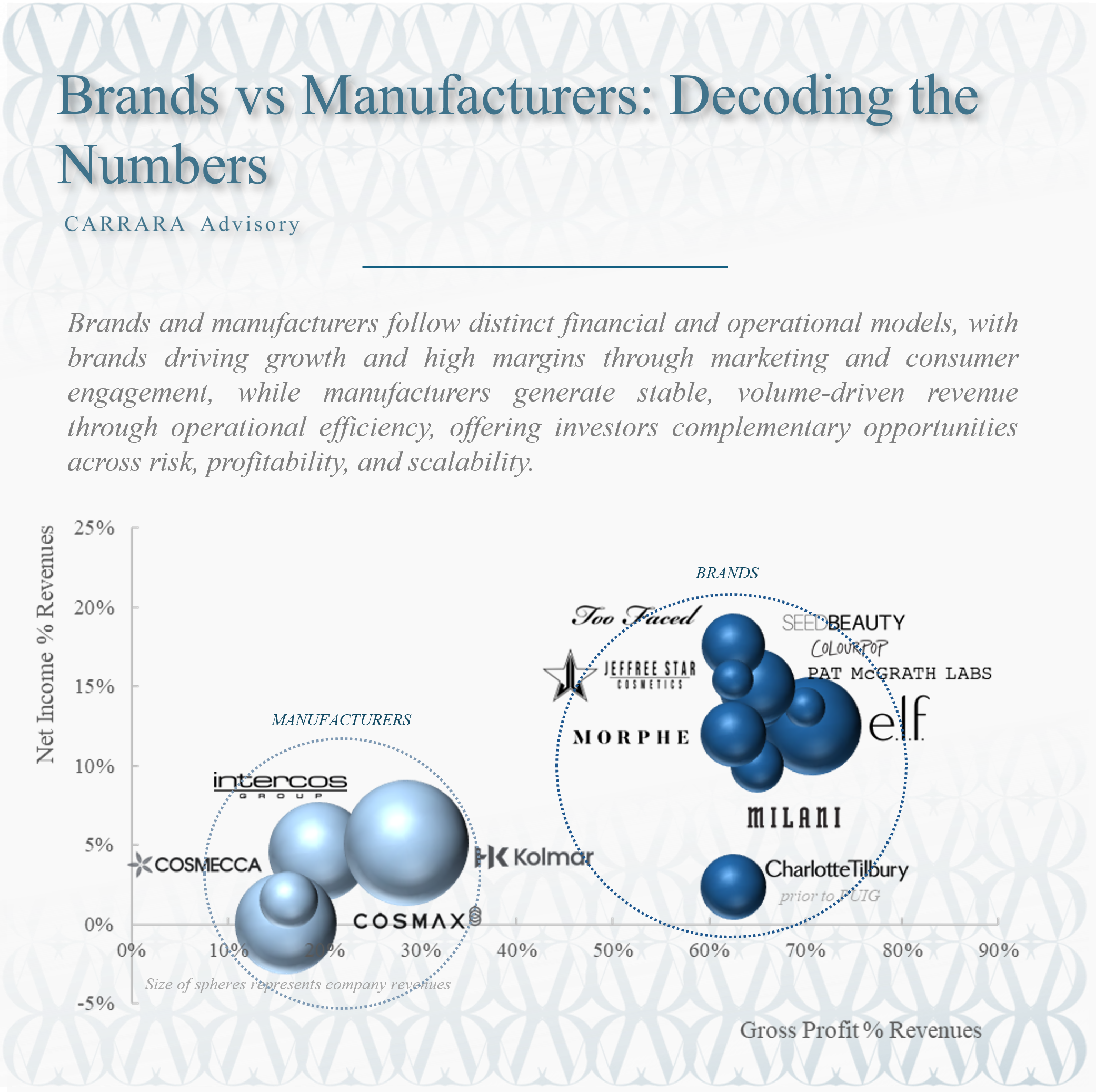

Brands vs Manufacturers: Decoding the Numbers

Brands and manufacturers follow distinct financial and operational models, with brands driving growth and high margins through marketing and consumer engagement, while manufacturers generate stable, volume-driven revenue through operational efficiency, offering investors complementary opportunities across risk, profitability, and scalability.

Inflation Resilience. Two Decades of Industry Winners and Losers

Over twenty years, industries differ sharply in their ability to outpace inflation, with brand-driven, emotionally valued, and innovation-led sectors like beauty, jewelry, apparel, and IT showing consistent real growth, while cyclical, regulated, or discretionary categories such as automotive, alcohol, and parts of pharma often underperform.

From H1 Struggles to Q3 Growth: Key Trends Shaping the Beauty Industry

A clear recovery, with growth driven by agile, innovation-focused brands, strategic turnarounds, and strong execution across channels and regions, while legacy mass-market segments continue to face pressure.

In-House vs Licensing: Strategic Choices and the Cost of Control

While licensing offers a low-risk, capital-light entry and in-house delivers greater control, profitability, and long-term brand equity, the most effective path is not fixed but depends on each brand’s context.

In-House vs. Licensing: Why Luxury Fashion Houses Struggle with Beauty.

Luxury fashion houses are increasingly re-evaluating the balance between licensing and in-house beauty operations, with mixed success, as seen in the contrasting strategies of Hermès, Chanel, Kering, Richemont, and Dolce & Gabbana.

Proya Group: The Blueprint of China’s Rising Beauty Empires

Proya Group’s rise from a local Chinese skincare brand to a digitally-driven, multi-brand powerhouse exemplifies how China’s new beauty empires combine data-driven insight, agile brand management, and strategic sequencing to scale domestically and prepare for global expansion.

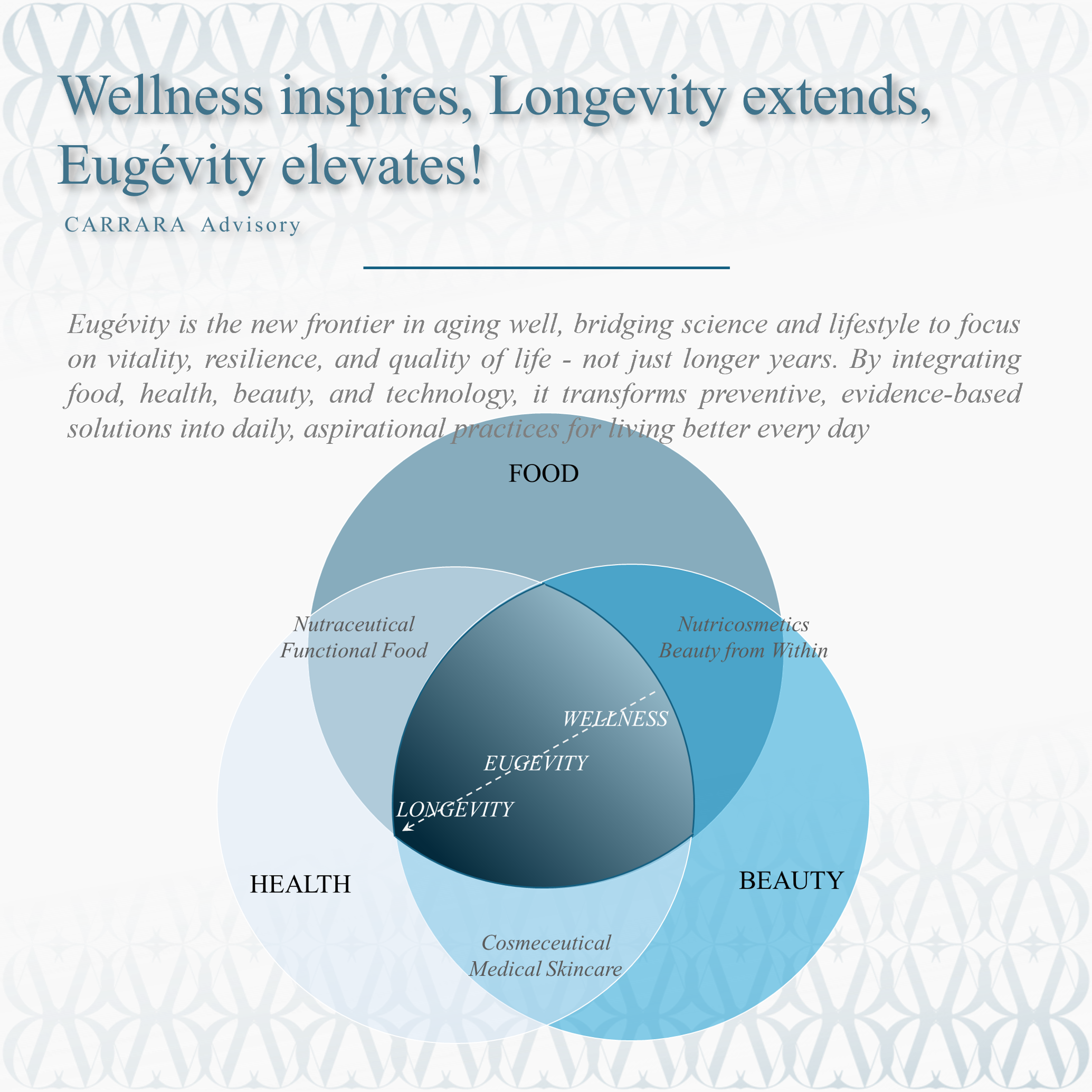

Eugévity: The Emerging Paradigm in Aging Well

Eugévity is the new frontier in aging well, bridging science and lifestyle to focus on vitality, resilience, and quality of life - not just longer years. By integrating food, health, beauty, and technology, it transforms preventive, evidence-based solutions into daily, aspirational practices for living better every day

Private Equity is Shaping the Next Generation of CDMOs - 1Q Health Case

The beauty and wellness industries are converging, driving rapid growth, and pushing traditional CMOs further evolve into full-service CDMOs offering end-to-end solutions from formulation to brand support. Private equity is now shaping this space by building next-generation platforms that combine speed, scientific credibility, and integrated services to meet the rising demand.

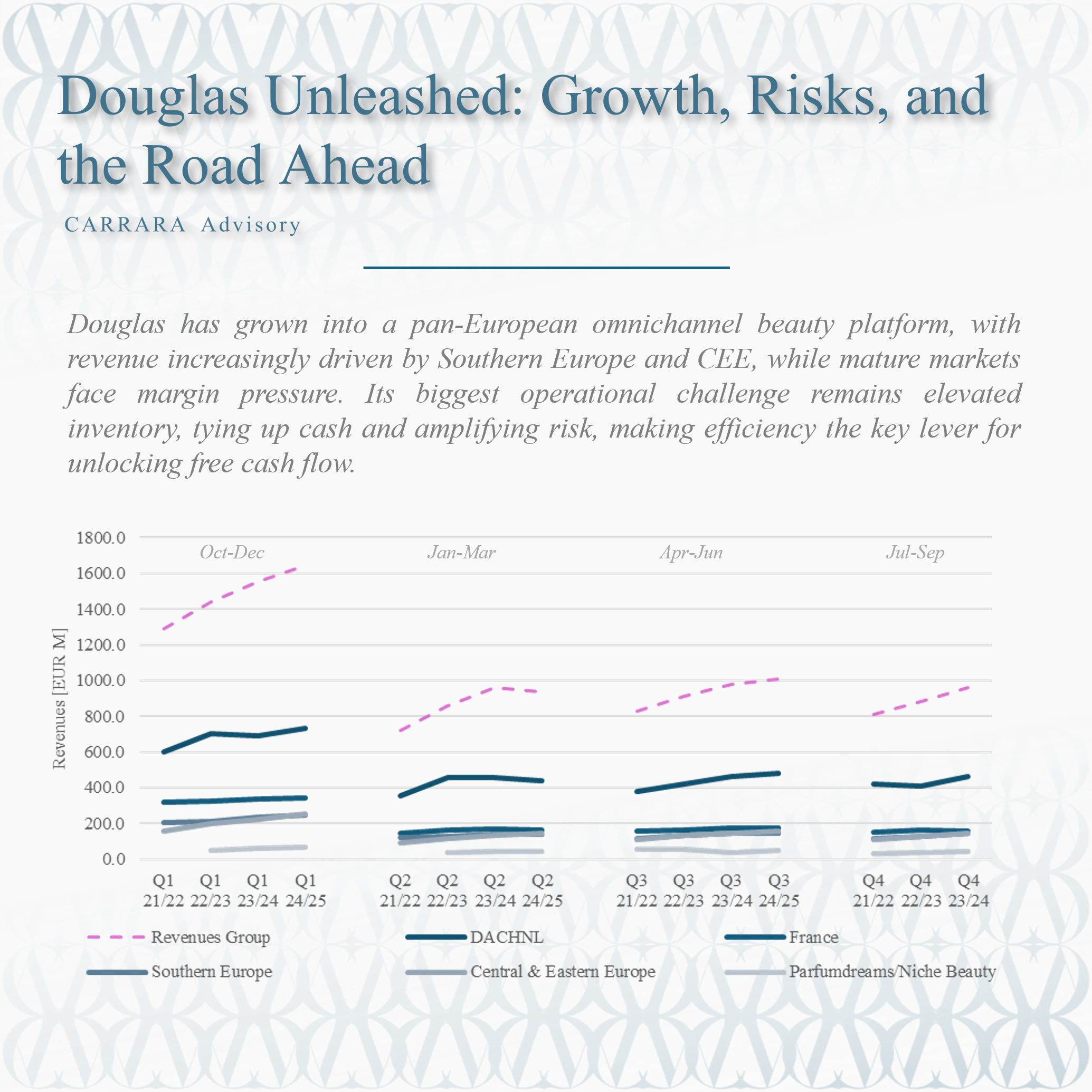

Douglas Unleashed: Revenue, Risk, and the Road to a Balanced Future

Douglas has grown into a pan-European omnichannel beauty platform, with revenue increasingly driven by Southern Europe and CEE, while mature markets face margin pressure. Its biggest operational challenge remains elevated inventory, tying up cash and amplifying risk, making efficiency the key lever for unlocking free cash flow.

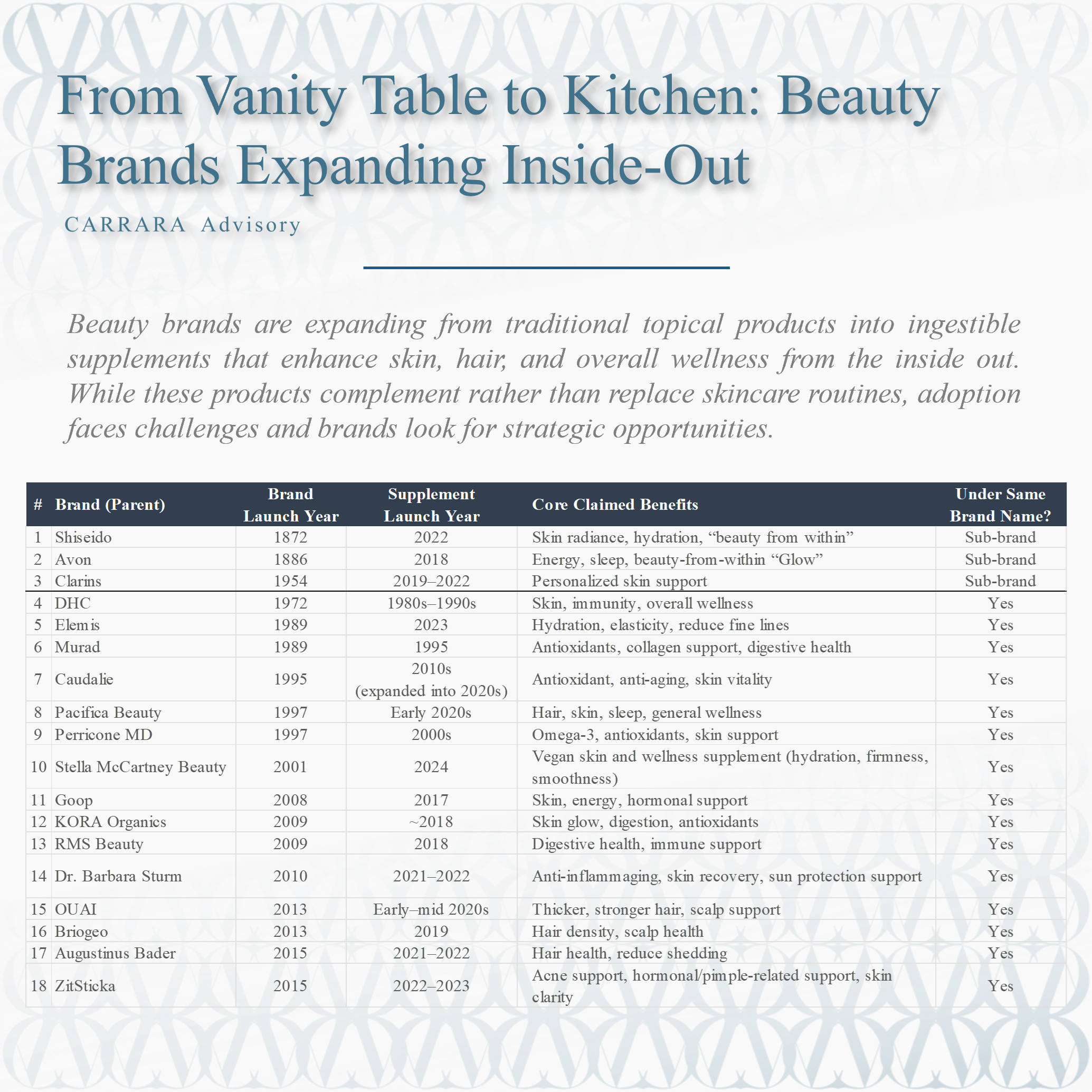

From Vanity Table to Kitchen: Beauty Brands Expanding Inside-Out

Beauty brands are expanding from traditional topical products into ingestible supplements that enhance skin, hair, and overall wellness from the inside out. While these products complement rather than replace skincare routines, adoption faces challenges and brands look for strategic opportunities.

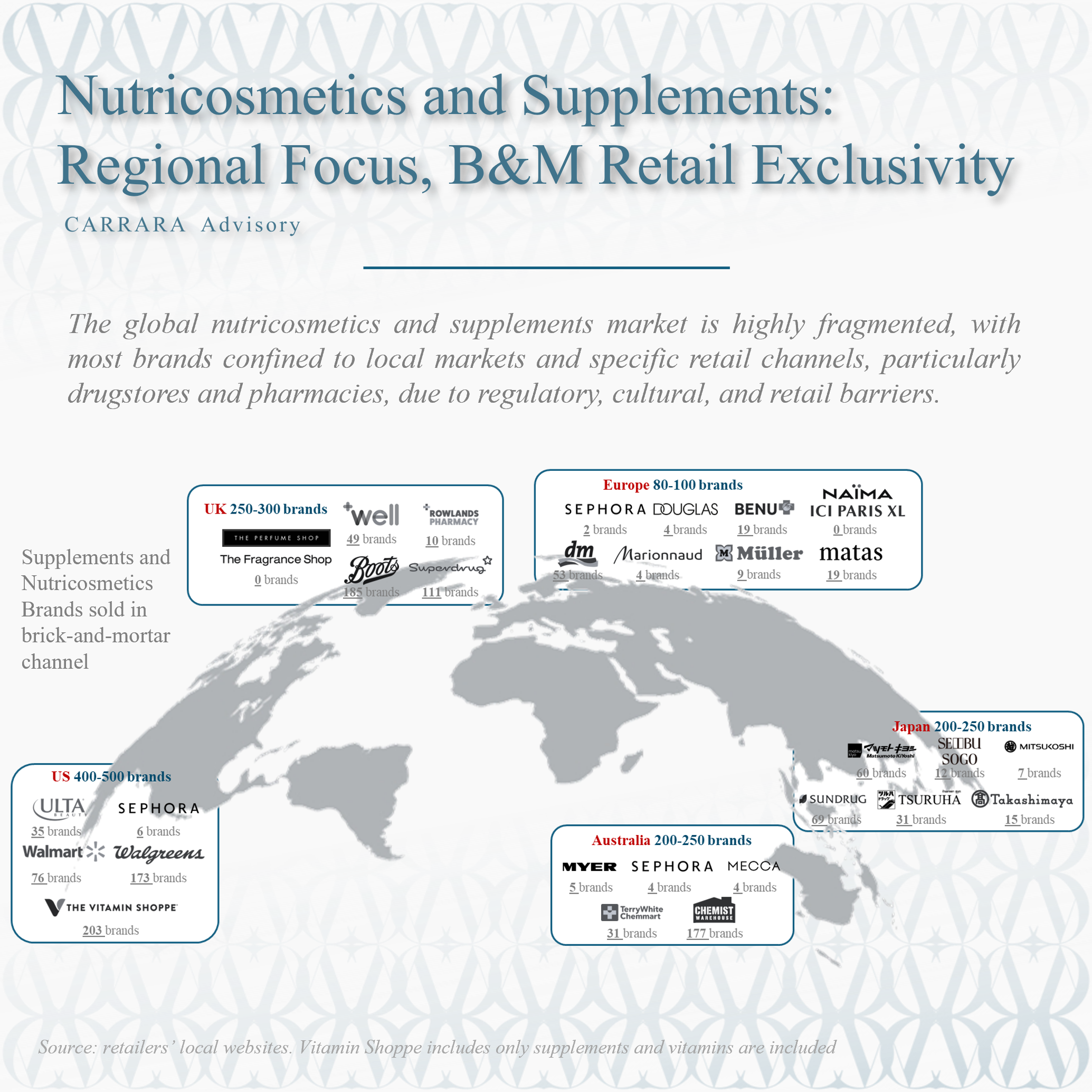

Nutricosmetics and Supplements: Regional Focus, B&M Retail Exclusivity

The global nutricosmetics and supplements market is highly fragmented, with most brands confined to local markets and specific retail channels, particularly drugstores and pharmacies, due to regulatory, cultural, and retail barriers.

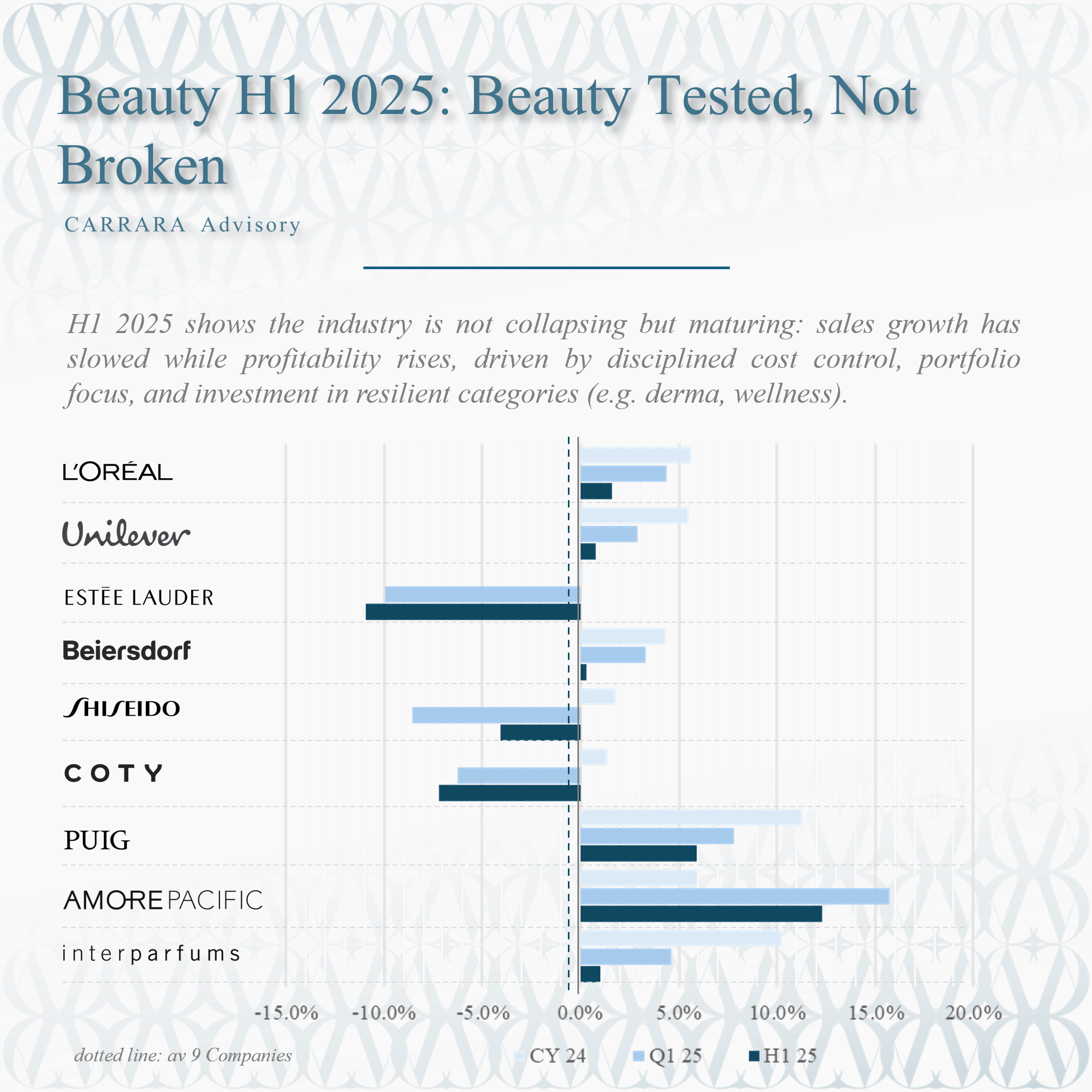

H1 2025 Beauty Tested, Not Broken

H1 2025 shows the industry is not collapsing but maturing: sales growth has slowed while profitability rises, driven by disciplined cost control, portfolio focus, and investment in resilient categories (e.g. derma, wellness).

Intercos: The Unseen Force Powering the World’s Biggest Beauty Brands

Intercos doesn’t sell to consumers, yet it shapes what millions apply daily. With strategic acquisitions, a “glocal” footprint, and a laser focus on R&D, Intercos has gone from Milan startup to global force powering most of the world’s top 30 beauty brands and hitting €1B+ revenues despite major disruptions.

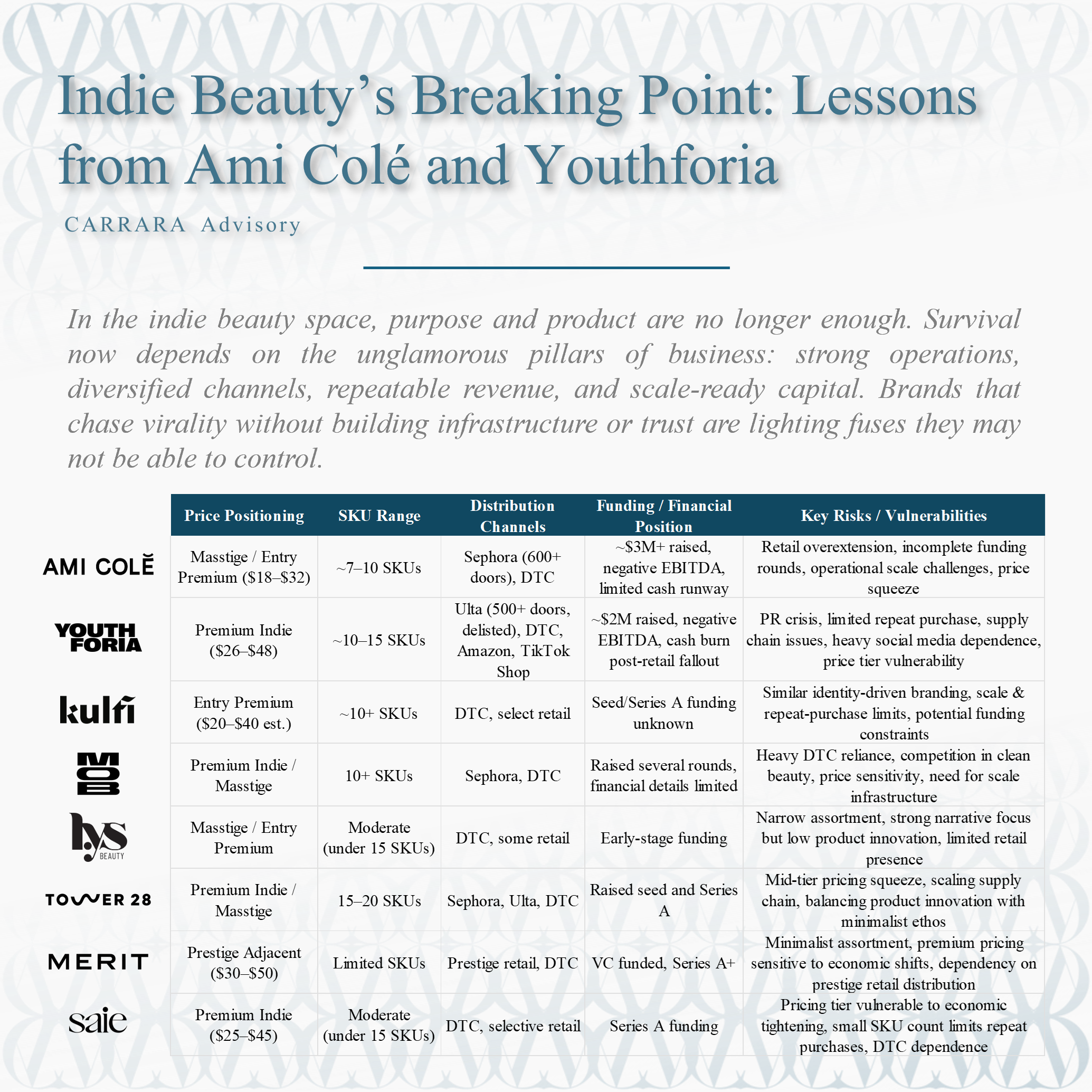

Indie Beauty’s Breaking Point: Lessons from Ami Colé and Youthforia

In the indie beauty space, purpose and product are no longer enough. Survival now depends on the unglamorous pillars of business: strong operations, diversified channels, repeatable revenue, and scale-ready capital. Brands that chase virality without building infrastructure or trust are lighting fuses they may not be able to control.

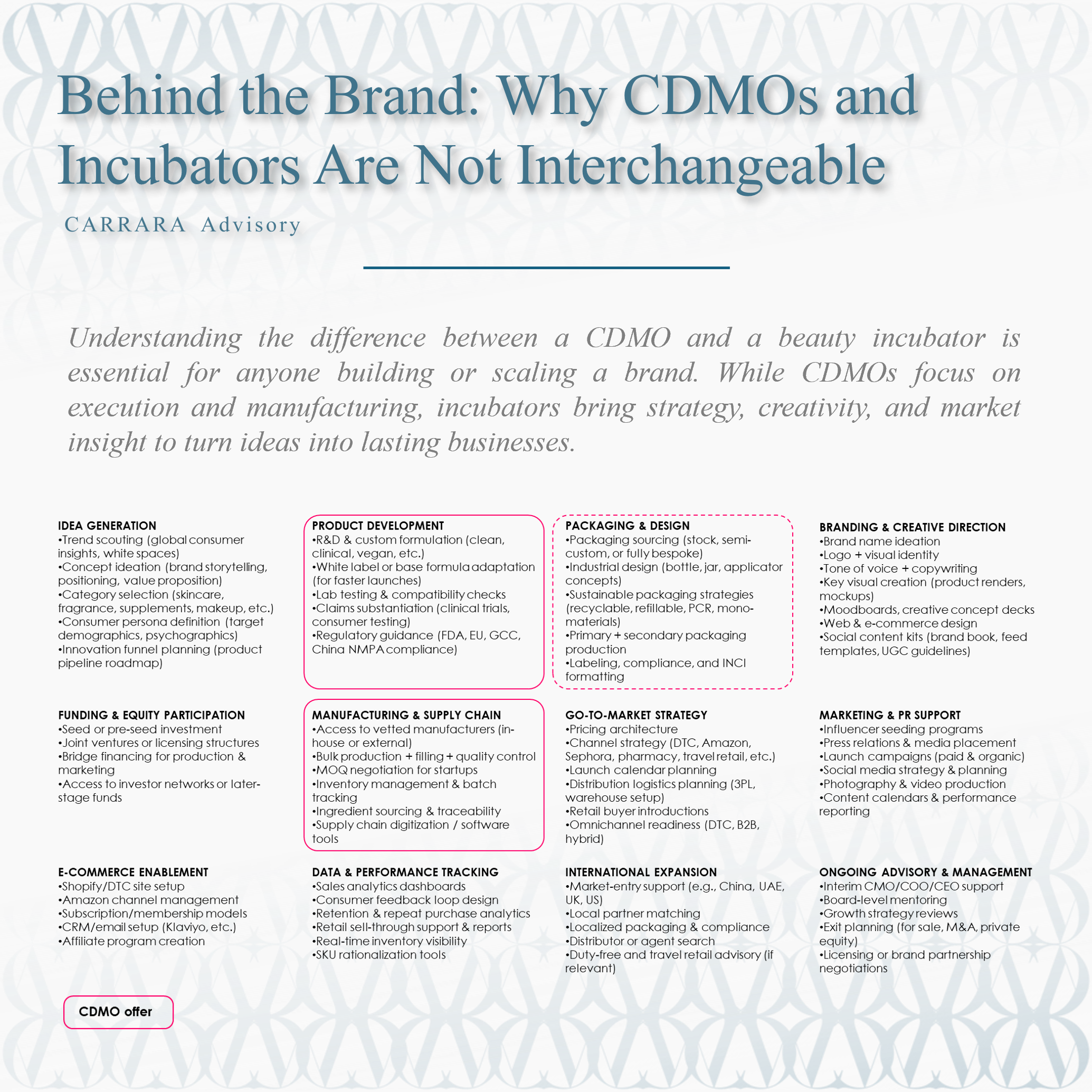

Behind the Brand: Why CDMOs and Incubators Are Not Interchangeable

Understanding the difference between a CDMO and a beauty incubator is essential for anyone building or scaling a brand. While CDMOs focus on execution and manufacturing, incubators bring strategy, creativity, and market insight to turn ideas into lasting businesses.

Stylist Roots, Celebrity Influence: The New Wave of Haircare Brands

Celebrity and hairstylist-founded haircare brands have skyrocketed in influence, evolving from niche salon lines to powerful lifestyle icons championing authenticity, inclusivity, and sustainability. This transformation is reshaping the beauty market.