1. Benchmark the competitive landscape. This does not mean copying competitors but understanding the price signals in each subcategory. Benchmarking should highlight where the brand is underpriced or overpriced relative to its promise.

2. Define the brand’s strategic positioning with precision. The brand must decide whether it competes on premium differentiation, clinical efficacy, natural formulation, innovation leadership or mass accessibility. Pricing must reflect this identity. Without a clear strategic anchor, pricing becomes arbitrary.

3. Design to contribution margin at the SKU level. Profitability must be understood at line item detail. Many mid-market brands underestimate the variation in margin between products. Some products may carry the company while others silently erode profitability. SKU level clarity is essential before any pricing decision.

4. Evaluate channel economics. The company must understand the impact of trade terms, distributor discounts and retail markups. Pricing must be harmonized across channels to avoid conflict. If necessary, the brand should redesign its entire pricing ladder to ensure coherence.

5. Construct a disciplined promotional policy. Promotions must be tied to clear objectives. The company should quantify the long term impact of discounts on margin and customer behavior. Leadership must adopt the principle that promotions are a strategic tool, not a crutch.

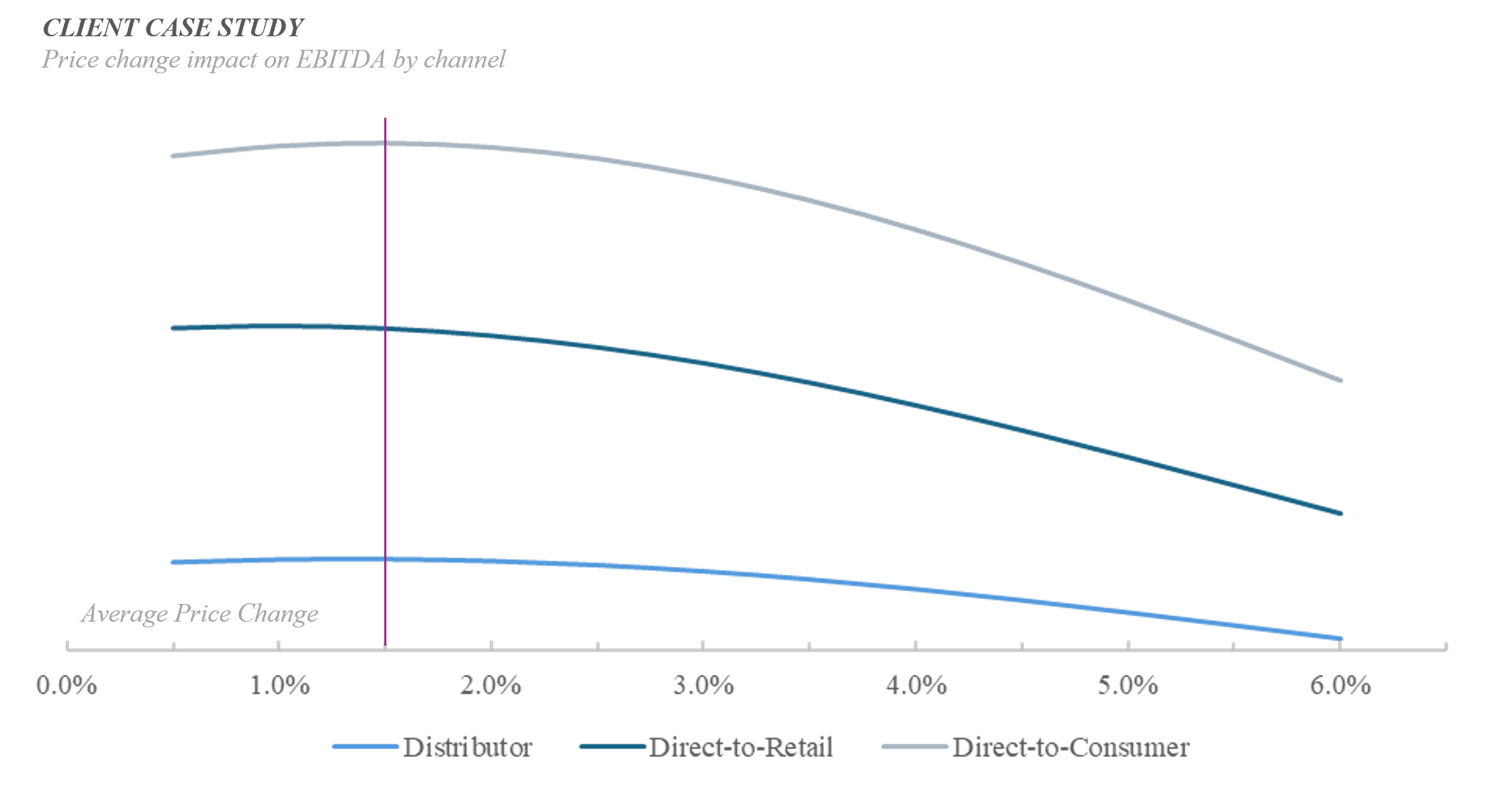

6. Model price elasticity and test controlled price increases. Even moderate increases can have a large financial impact. Testing allows the company to understand consumer behavior and fine tune the architecture.

7. Implement governance. Pricing decisions must not be left to intuition or external pressure. The company should establish a pricing committee or at least a structured review process. Pricing discipline comes from process, not personality.

How pricing strengthens negotiation power with retailers and distributors

A brand with a coherent, data-based pricing architecture commands respect from its partners. Retailers see the brand as stable, predictable and professionally managed. They become more willing to provide visibility, promotions and placement. Distributors gain confidence that the company understands market dynamics and protects their commercial interests.

On the other hand, retailers and distributors immediately sense when a brand is uncertain about its pricing. They push harder, request deeper discounts and demand more support. The brand becomes reactive, losing leverage and accepting terms that gradually weaken profitability.

A disciplined pricing strategy reverses this relationship. Instead of reacting to retailer pressure, the brand leads the conversation. It sets expectations, defends its margins and builds partnerships based on mutual respect. Strong pricing is a foundation for strong commercial relationships.

The compounding benefits of pricing discipline

When a beauty brand rebuilds its pricing structure, the benefits go beyond immediate financial gain. Pricing discipline strengthens internal accountability. It forces clarity on product profitability, channel strategy and brand narrative. It encourages better forecasting. It reduces operational waste. It creates confidence among investors and partners. Most importantly, it provides leadership with a stable financial base from which to pursue growth.

Pricing is one of the few strategic levers that can deliver rapid impact without requiring additional capital. It is a lever entirely within the company’s control. When applied correctly, pricing becomes a source of strength, clarity and strategic momentum.

Final considerations

Many mid-market beauty companies believe their challenges are rooted in marketing or distribution. In reality, a significant portion of their difficulties stem from pricing misalignment. When pricing does not reflect the true value of the brand, the company fights against gravity. Every sale becomes harder. Every investment becomes riskier. Every operational decision becomes more fragile.

A disciplined pricing strategy brings order where there was confusion. It strengthens profitability, stabilizes the organization and unlocks growth capacity. It signals confidence to consumers and professionalism to partners. For beauty brands operating in a competitive and fast moving landscape, pricing excellence is not optional. It is a strategic necessity.

If leadership approaches pricing with the same seriousness applied to product development and brand storytelling, the entire organization becomes more resilient and more capable. Pricing is not simply a number. It is the financial backbone of the brand. When mastered, it changes the trajectory of the business.