The Retailer Taking the European Landscape by Storm: Action!

Executive Summary

Founded in 1993 in Enkhuizen, the Netherlands, Action has grown from a single local discount store into Europe’s fastest-growing non-food retailer, operating over 3,000 stores across 14 countries. The company employs around 70,000 people and generated approximately €13.8 billion in revenue in 2024, reflecting a robust growth trajectory.

Action’s success is rooted in a clear value proposition: offering a broad assortment of quality products at consistently low prices, delivered with high operational efficiency and a unique “treasure hunt” shopping experience. This combination of affordability, variety, and discovery has become the cornerstone of its appeal.

In the fast-paced European discount retail sector, few companies have achieved both rapid expansion and sustained improvements in store productivity as effectively as Action. The retailer’s growth, is remarkable not just for scale, but also for the counterintuitive rise in revenue per store during a period of exponential openings - a feat rarely seen in the low-price, high-assortment segment.

Historical Evolution

Action’s trajectory reflects a combination of opportunistic market entry, disciplined operational management, and keen insight into consumer behavior. The company opened its first store in 1993 in Enkhuizen, focusing on affordable household and personal items. Early expansion within the Netherlands allowed the company to refine its sourcing, inventory management, and store format.

By 2005, Action had entered Belgium, signaling the start of its cross-border expansion. Entry into Germany in 2009 marked a critical step, exposing the company to one of Europe’s largest retail markets. The 2010s witnessed accelerated growth across multiple European markets, including France, Austria, Poland, and the Czech Republic.

Key milestones include:

2015: Exceeded 1,000 stores across multiple European countries.

2020: Surpassed 2,000 stores, despite the disruption of the COVID-19 pandemic.

2023: Opened its 2,500th store, demonstrating resilience and market traction.

2025: Approached the 3,000-store mark, solidifying its presence as a pan-European discount powerhouse.

Action’s expansion strategy has been deliberate yet aggressive, leveraging both greenfield openings and selective acquisitions to secure prime retail locations. Its operational discipline and low-cost model have allowed rapid scaling without compromising profitability.

Business Model and Value Proposition

Action’s business model is centered around several core pillars:

Value-Driven Pricing: A majority of Action’s assortment is priced under €5, with roughly two-thirds under €2. This creates a low-entry barrier for consumers and encourages frequent store visits.

Treasure Hunt Experience: Action continuously rotates products, introducing over 150 new items per week. This fosters a sense of discovery and urgency, encouraging impulse purchases.

Operational Efficiency: Action operates a centralized supply chain with direct procurement from manufacturers, optimizing cost and inventory turnover. This allows the company to maintain low prices while ensuring quality standards.

High Volume, Low Margin Strategy: The company’s profitability model depends on selling large quantities of low-priced goods rather than relying on high-margin items. This requires meticulous control of logistics, sourcing, and store operations.

Localized Adaptation: While the store layout and product categories are largely standardized, Action tailors certain products to local tastes, cultural preferences, and regulatory requirements, enhancing market acceptance.

This model creates a compelling balance between cost leadership and customer engagement, allowing Action to sustain high performance across diverse European markets.

Product Portfolio

Action offers a broad and diverse assortment spanning 14 key categories, carefully balancing staples with novelty items to drive repeat and impulse purchases:

Household Goods: Everyday essentials such as kitchenware, cleaning products, and storage solutions.

Personal Care: Toiletries, hygiene products, and hair and skin care.

Food & Beverage: Non-perishable food, snacks, and drinks, positioned as convenient low-cost options.

DIY and Tools: Small hardware, paint, and gardening supplies.

Toys and Entertainment: Children’s toys, puzzles, and games.

Clothing and Linen: Seasonal apparel, basic clothing items, towels, and bedding.

Stationery and Hobby: Office supplies, craft materials, and school items.

Decoration: Seasonal and everyday home decor, including ornaments and wall art.

Garden & Outdoor: Furniture, outdoor accessories, and gardening tools.

Multimedia: Small electronics, accessories, and tech-related items.

Sports Equipment: Basic gear and accessories for recreational use.

Pets: Food, bedding, toys, and grooming items for pets.

Seasonal Specials: Products tied to holidays or short-term trends.

Miscellaneous: Occasional novelties, gifts, and local-specific items.

The assortment strategy balances staples that drive repeat purchases (cleaning products, personal care, household essentials) with novelty items that encourage impulse buying and frequent store visits.

Operational Strategy

Action’s operational strategy underpins its low-cost, high-volume model:

Supply Chain Optimization: Centralized procurement hubs enable bulk purchasing and negotiation leverage with suppliers.

Inventory Management: Frequent replenishment and precise demand forecasting ensure high product availability while minimizing excess inventory.

Store Layout and Design: Stores are designed for efficiency, guiding customers through high-traffic aisles with strategically placed impulse items.

Human Capital Strategy: Employee training emphasizes operational efficiency, customer service, and flexibility to adapt to rotating product assortments.

This integrated approach allows Action to maintain low operating costs while sustaining rapid expansion across multiple countries.

Market Position and Competitive Landscape

Action occupies a unique position in the European retail landscape: a non-food discount retailer that combines elements of traditional hard discounters with variety store concepts. Its primary competitors include:

Lidl and Aldi (Non-Food Sections): Compete on pricing and essentials, but offer more limited product categories.

Flying Tiger Copenhagen and Poundland: Compete on novelty items and the treasure-hunt shopping experience.

Local Discount Chains: Country-specific competitors in Belgium, Germany, France, and Central Europe.

Action differentiates itself through the combination of breadth of assortment, aggressive store expansion, operational efficiency, and consistent low pricing.

SWOT Analysis

Strengths:

Pan-European presence with strong brand recognition.

Efficient supply chain and low-cost operations.

Frequent introduction of new products drives customer engagement.

Scalable, standardized store model with flexibility for local adaptation.

Weaknesses:

Limited e-commerce and digital presence.

Heavy reliance on physical stores and in-person traffic.

Low-margin business model susceptible to cost inflation.

Opportunities:

Expansion into e-commerce and omni-channel capabilities.

Geographic expansion into Eastern Europe and non-European markets.

Sustainability initiatives and eco-friendly product lines to attract conscious consumers.

Leveraging data analytics for inventory optimization and personalized marketing.

Threats:

Intensifying competition from both traditional discounters and variety stores.

Economic downturns that could depress discretionary spending.

Rising logistics and labor costs that could pressure margins.

Changing consumer behavior, including shifts toward online shopping and subscription services.

Growth, Expansion, and Store Productivity

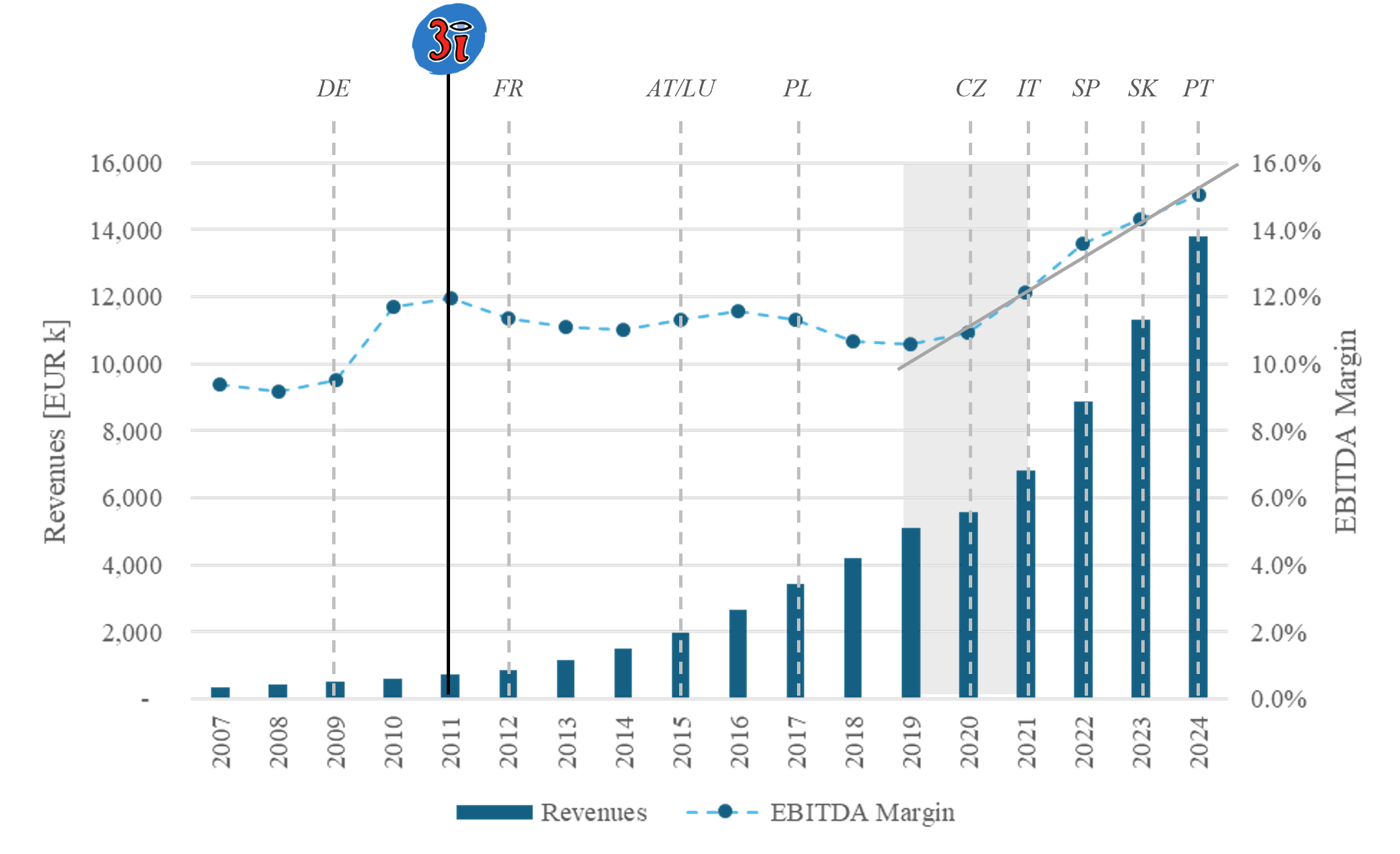

Action’s geographic roll-out illustrates a carefully sequenced market-entry strategy. Following its Dutch debut, the company entered Belgium in 2005, Germany in 2009, France in 2012, and gradually expanded to Austria and Luxembourg (2015), Poland (2017), the Czech Republic (2020), Italy (2021), Spain (2022), Slovakia (2023), Portugal (2024), and Switzerland (2025). This sequential market penetration has ensured that new stores generally target under-served regions, generating incremental demand rather than cannibalizing existing sales.

The 2011 acquisition of Action by private equity firm 3i marked a pivotal moment in the company’s evolution. With significant capital injection and strategic oversight, 3i enabled Action to accelerate its expansion across Europe while professionalizing key operational functions. Investments funded the establishment of state-of-the-art distribution centers, enhancements to IT infrastructure, and optimization of logistics processes, creating the backbone for scalable growth. Beyond financial support, 3i brought governance expertise and industry insight, guiding management in refining the store rollout strategy, procurement efficiency, and cost discipline. This partnership allowed Action not only to pursue aggressive geographic expansion but also to improve store-level performance, setting the stage for the remarkable increases in revenue per store and mid-teens EBITDA margins observed in subsequent years.

Consistent Growth in Store Productivity

Store productivity has been consistently growing, then between 2017 and 2020, revenue per store stabilized at approximately €3.4–€3.9 million, and that despite a rapidly growing store network. Several validated factors contributed to this counterintuitive outcome:

Like-for-like sales growth: Action reports LFL sales of 16.7% in 2023 and 10.3% in 2024. LFL growth means existing stores sold significantly more (more customers and/or higher ticket), so store productivity rose independent of net new openings. That alone explains a large part of revenue/store acceleration.

Additive expansion: The sequential entry into new countries ensured that each new store largely generated incremental revenue by tapping new markets. In fact, opening in countries and regions with little prior presence created new customers, not cannibalized ones.

Operational and procurement leverage: Investments in logistics, central buying, and IT enabled better SKU availability and in-store execution, increasing conversion rates and average basket size.

Rising customer traffic and transactions: Action itself states its 2024 sales growth was driven by “more transactions” and rising customer numbers visiting stores. That is a direct claim that volume (frequency or visits) rose at existing stores - the most direct path to higher sales per door.

This combination of factors explains how Action simultaneously managed rapid expansion and rising store productivity - a rare achievement in European discount retail.

Furthermore, from 2021 onward, store productivity accelerated, reaching an average of €4.7 million per store by 2024. Such acceleration is a compound of:

1. Post-pandemic demand recovery and structural trading-down to value retailers. After 2020-2021 lockdowns, consumers returned to stores and many shifted spending toward value/discounter formats. Action’s strong LFL growth from 2021 onward is consistent with a value-tilt in consumer behaviour and a pent-up demand effect

2. Inflationary nominal ticket uplift. From 2021–2023 Europe experienced above-trend inflation. For a discounter like Action, even modest nominal price increases or price mix shifts translate into meaningful revenue/store uplift. While Action reports emphasize volume, they also note price reductions in some quarters, which implies they actively manage price to capture share - yet inflation likely lifted nominal sales too.

3. Scale inflection in Action’s operational capacity that began to convert earlier capex into higher in-store availability and conversion. 3i and Action narrative point to operating leverage: investments in DCs, IT, procurement and process improvements made earlier enabled higher fill rates and better assortment execution by 2021–2023, producing stronger conversion at store level.

Margin Dynamics and Operational Efficiency

Despite rising store productivity, Action’s EBITDA margin remained relatively stable before 2021. This apparent anomaly can be explained by the company’s aggressive reinvestment strategy: opening hundreds of stores each year, establishing distribution centers, and onboarding staff all entail upfront costs that temporarily offset incremental revenue. Additionally, rising operating costs - including labor and transport - moderated margin expansion during this period.

Reinvestment (supporting expansion): Opening hundreds of stores and building supporting logistics/IT requires upfront fixed and operating spend (DC capacity, staff, onboarding, lease commitments). These costs depress EBITDA until throughput rises enough to spread them. 3i commentary notes that margin improvements came as scale benefits kicked in — implying earlier reinvestment.

Rising operating costs (wages, transport) in certain earlier years. Industry reporting and Action’s references to cost discipline indicate cost inflation pressured margins until later optimization reduced per-unit costs. Pepco, B&M and others reported that labor and transport inflation increased operating costs around the same period - validating the idea that cost headwinds offset revenue gains industry-wide.

Mix & tactical pricing: If a portion of revenue uplift came from low-margin staples or promotional SKUs used to drive traffic, early top-line growth would not translate proportionally into EBITDA. Action’s own commentary that sales growth was driven by more transactions (and that it performed many price reductions in 2023/2024) supports the idea of a partly mix-driven growth.

From 2021 onward, EBITDA margin began to improve, reaching mid-teens levels by 2024 (~15.1%). This increase is attributable to several validated drivers:

Operating leverage: Incremental sales flowed through existing fixed-cost structures, improving bottom-line efficiency. With distribution and IT investments commissioned, incremental sales flowed to the bottom line. 3i and Action state explicit margin improvement and attribute it to scale and cost discipline; operating EBITDA rose ~29% in 2024 vs 2023 and margin to c.15.1% (2024).

Procurement scale: Greater volumes and centralized buying allowed Action to negotiate better supplier terms and improve gross margins. Action and 3i cite scale benefits explicitly.

Gross margin recovery and SKU mix optimization: Category and assortment refinements favored higher-margin items and private labels, further boosting profitability. Some peers (Pepco, B&M) reported gross margin improvements as freight/commodity effects normalized. Action’s improved margin profile is consistent with an industry-wide recovery of gross margins and refinements to assortments that favor higher margin SKUs/ private labels over time.

Benchmarking Action’s EBITDA Margin

Action’s mid-teens EBITDA margin is notable for a low-price, high-assortment retailer. To provide context:

Pepco Group, a European variety discounter, reported an underlying EBITDA margin of ~13.3% in FY23.

B&M European Value Retail, another European discounter, operates at ~11–12% EBITDA margin historically.

US dollar stores such as Dollar General and Dollar Tree operate in the 10–12% range, with some volatility.

For a retailer managing thousands of SKUs at low price points, achieving a mid-teens EBITDA margin reflects exceptional operational execution, supply chain sophistication, and buying power.

Patterns and Anomalies Worth Highlighting

High LFL growth during expansion: LFL growth of 16.7% in 2023 is unusually high for an already mature retailer, signaling strong underlying demand or effective assortment and traffic-driving strategies.

Seasonality concentration: A disproportionate share of sales and EBITDA occurs in Q4, creating potential volatility in financial performance.

Operational excellence required for sustained performance: Delivering rising store productivity alongside rapid expansion requires flawless execution in logistics, staffing, and merchandising.

Accounting nuances: Reported EBITDA is sensitive to IFRS16 lease accounting and one-off items; careful diligence is required for cross-retailer comparisons.

Action’s combination of rapid expansion, strong store productivity, and high operating margins positions it as a standout in European value retail. For investors and strategic partners, this performance signals operational strength, robust market positioning, and disciplined execution. However, due diligence should verify margin sustainability, seasonality exposure, and the contribution of new versus existing stores.

Strategic Considerations and Recommendations

For sustained growth, Action should consider:

Digital Transformation: Developing a comprehensive e-commerce platform with a curated selection of high-frequency and high-margin items could diversify revenue and build resilience against potential declines in foot traffic.

Sustainability Leadership: Integrating eco-friendly product lines and packaging could attract a growing segment of environmentally conscious consumers, while also mitigating regulatory risks.

Product Innovation and Private Label Expansion: Leveraging private labels can improve margins, allow differentiation, and strengthen customer loyalty.

International Expansion: While Action is already established across Europe, targeted entry into underpenetrated markets could extend the company’s footprint and revenue base.

Data-Driven Operations: Greater investment in predictive analytics for inventory, pricing, and customer behavior can optimize product assortment, reduce waste, and enhance profitability.

Conclusion

Action’s rapid growth is a testament to its disciplined operational model, strategic store expansion, and deep understanding of consumer behavior. The company has successfully combined the appeal of a low-cost retailer with the engagement of a treasure-hunt shopping experience.

Action’s story is one of exceptional scale, operational discipline, and profitable growth. While the low-price, high-assortment retail segment typically faces margin pressure and cannibalization risks, Action has demonstrated a rare ability to expand aggressively while improving unit economics. The mid-teens EBITDA margin underscores the company’s efficiency and positions it favorably against both European and US peers.

By addressing digital gaps, sustainability expectations, and leveraging data-driven insights, Action is well-positioned to maintain its leadership in the European discount retail sector while exploring new growth avenues. Its model offers valuable lessons in scalability, operational excellence, and strategic market positioning for retailers and investors alike.

For stakeholders in the retail and private equity landscape, Action offers a compelling case study of value retail executed at scale.

#Retail #DiscountRetail #ValueRetail #Strategy #PrivateEquity #Action #BusinessGrowth #RetailInnovation #ConsumerTrends #RetailStrategy #CarraraAdvisory