Intercos: The Unseen Force Powering the World’s Biggest Beauty Brands

In the glittering world of cosmetics, where brand names dominate advertising and social media, Intercos S.p.A. operates in the shadows - quietly shaping the products that millions use every day. As one of the world’s leading contract development and manufacturing organizations (CDMOs) in the beauty industry, Intercos does not sell directly to consumers. Instead, it functions as a strategic B2B partner, developing and manufacturing color cosmetics, skincare, hair care, and personal care products for a vast portfolio of clients, including 24 to 26 of the top 30 global beauty brands. Its client roster reads like a who’s who of the industry: L'Oréal, Estée Lauder, Coty, Shiseido, and Dolce & Gabbana, among others. Yet, despite its outsized influence, Intercos remains largely unseen by the end user - a silent engine powering the beauty ecosystem.

Origins and Strategic Evolution

Intercos was founded in 1972 by Dario Ferrari in Milan, Italy, as a manufacturer specializing in color cosmetics. This early focus laid the foundation for what would become its core technical expertise: pigments, textures, and innovative delivery systems. Over the decades, Intercos evolved from a regional supplier into a global powerhouse, guided by a clear strategic vision: to become the indispensable innovation partner for beauty brands rather than compete with them as a consumer-facing label.

A pivotal shift occurred under the leadership of Renato Semerari, who assumed control as CEO in 2018. He played a transformative role, steering Intercos toward vertical integration and global expansion. He recognized a growing trend: beauty brands, especially in the luxury and prestige segments, were increasingly outsourcing R&D and manufacturing to specialized partners to accelerate time-to-market and reduce capital intensity. Intercos capitalized on this shift by investing heavily in research, automation, and international infrastructure.

Corporate Structure and Governance

Intercos is headquartered in Agrate Brianza, near Milan, Italy, operating as a truly global player with a footprint that spans Europe, the Americas, and Asia. As of 2025, the company manages 16 production plants and 11 R&D centers distributed across three continents, collectively employing approximately 4,000 people. This workforce has grown significantly over the past decade-from around 2,500 employees in 2011 to just over 4,000 by 2024-reflecting Intercos’s robust expansion both organically and through acquisitions.

Notably, alongside headcount growth, Intercos has achieved a steady increase in headcount productivity, measured as revenue generated per employee. Productivity nearly doubled over the period, rising from approximately €107,000 per employee in 2011 to over €261,000 per employee in 2024. This remarkable improvement demonstrates the company’s success in scaling its operations efficiently, driven by investments in automation, process optimization, and innovation.

Intercos’s “glocal” model underpins this growth, allowing the company to adapt formulations and packaging to specific regional consumer preferences-such as K-beauty-inspired textures in Asia or mineral-based sunscreens in Australia-while maintaining stringent global quality and compliance standards.

A significant milestone in Intercos’s corporate evolution was its initial public offering (IPO) on Euronext Milan in November 2021. The IPO brought in prominent institutional investors, including L Catterton, a private equity firm specializing in luxury brands, and GIC, Singapore’s sovereign wealth fund. Their investments have bolstered Intercos’s financial strength, providing enhanced credibility and the capital necessary to fuel strategic expansion into Asia and ongoing investments in innovation and technology.

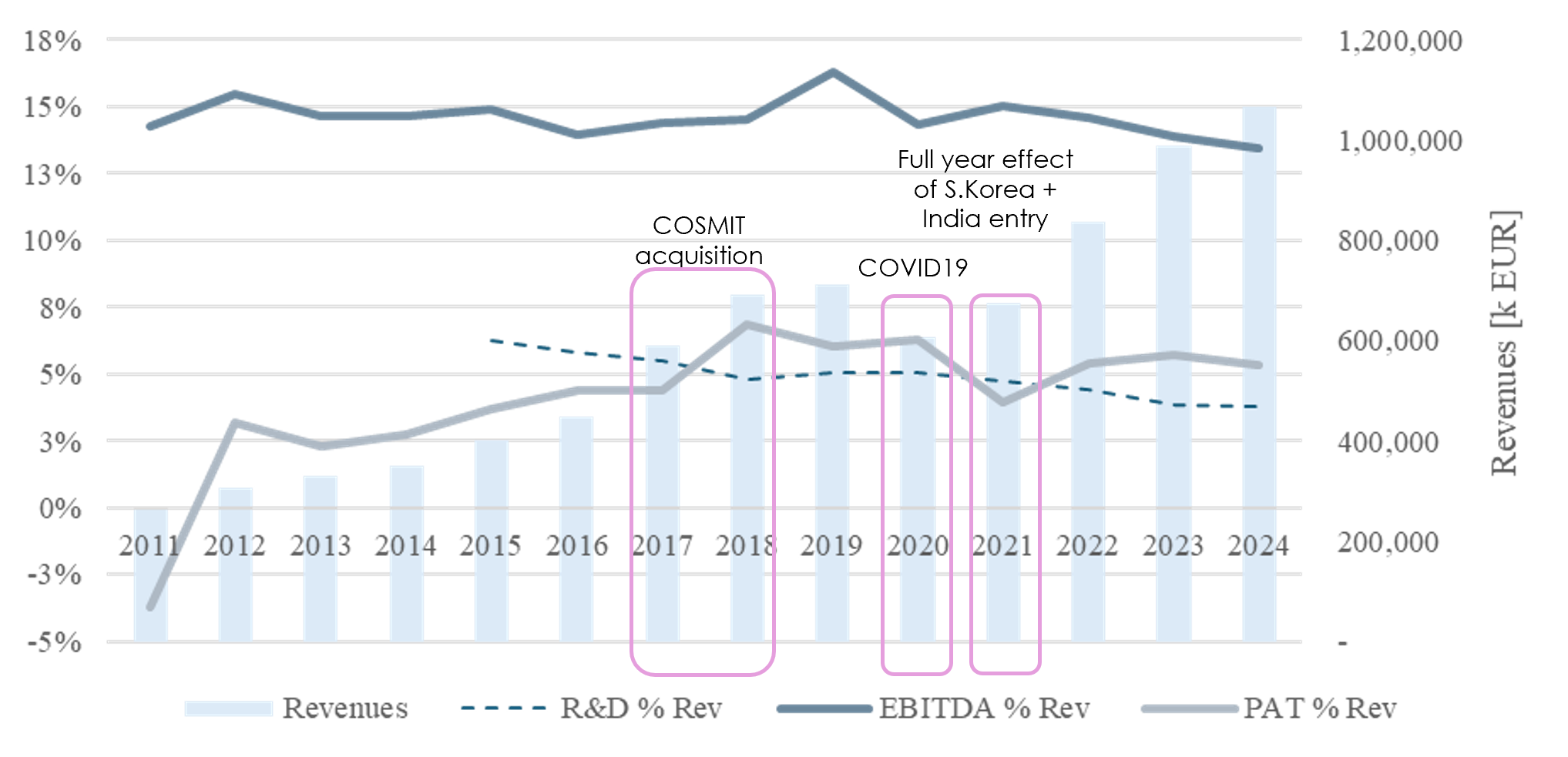

Financial Trajectory and Performance

Intercos’s financial history over the past decade tells the story of a company that has combined steady organic growth with transformative acquisitions to cement its leadership in the global beauty manufacturing market.

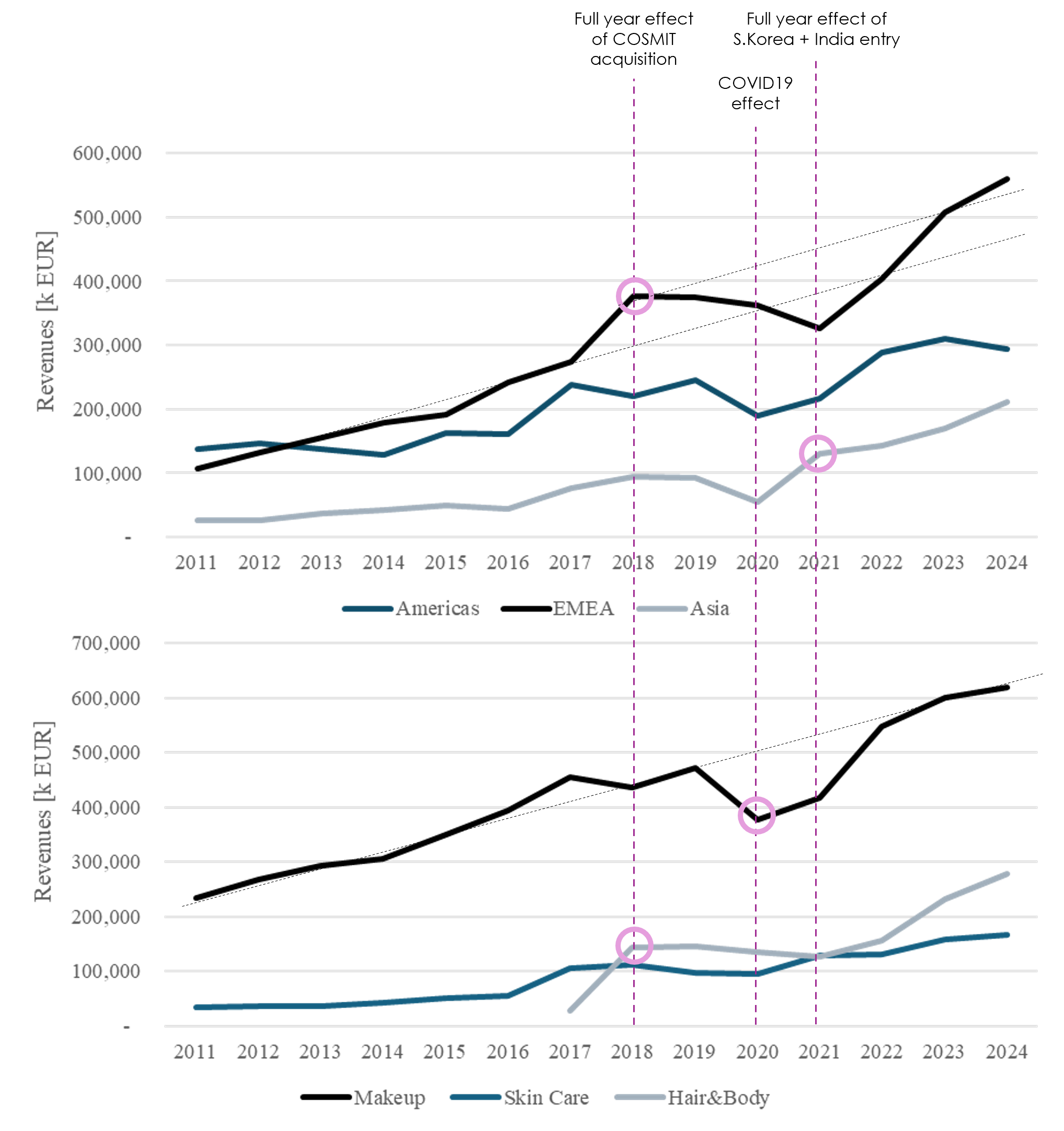

From €269.2 million in 2011, revenues expanded consistently until 2016 (€448.7 million), supported by robust demand for color cosmetics - the company’s historical core business - and an increasing push into skincare. A pivotal moment came in 2017 with the acquisition of Cosmint, a move that significantly bolstered Intercos’s skincare and hair & body care capabilities, while also strengthening its geographic presence in EMEA and Asia. That year, revenues surged 31.5% to €590.2 million, driven by a near doubling of skincare sales (+92%) and the inclusion of €28.0 million from the newly consolidated Hair & Body category. EMEA revenues jumped from €242.4 million to €274.8 million, while Asia sales rose from €44.8 million to €76.7 million.

The growth trajectory continued through 2019, when revenues peaked at €712.7 million before the industry faced its largest modern disruption: the COVID-19 pandemic. In 2020, revenues fell 14.9% to €606.5 million, with pronounced weakness in the Americas (-22.7%) and Asia (-39.9%) as lockdowns curtailed consumer spending and disrupted production. Makeup sales, the largest category, declined sharply (-20.1%), while skincare proved more resilient (-1.6%), highlighting the latter’s growing strategic importance.

A turning point came in 2021, when Intercos completed the acquisition of Intercos South Korea and entered the Indian market. This, combined with the post-pandemic rebound in beauty consumption, lifted revenues to €673.7 million (+11.1%). Asia revenues more than doubled to €130.6 million, while Americas sales recovered to €216.2 million.

The momentum carried into 2022 and 2023, with revenues reaching €835.6 million (+24.0%) and €988.2 million (+18.3%) respectively. Growth was broad-based: Makeup remained the largest contributor at 60.7% of sales in 2023 (€599.4 million), while Hair & Body achieved triple-digit growth since 2020, reflecting strong consumer demand for wellness-oriented beauty products. Skincare also posted double-digit gains, consolidating its role as the group’s second-largest category.

In 2024, despite a significant cyberattack that temporarily disrupted operations, Intercos crossed the €1 billion milestone for the first time, reporting €1.0649 billion in revenues (+7.8% YoY). EBITDA stood at €143.3 million (13.5% margin), while net profit (PAT) reached €56.7 million (5.3% margin). Although both EBITDA margin and PAT margin remain solid by industry standards, they have shown early signs of softening over the past two years, reflecting a combination of inflationary pressures on input costs, a higher mix of lower-margin categories, and extraordinary costs linked to operational disruptions.

Long-Term Profitability Trends

EBITDA margins have generally held between 13–16% over the period, reflecting operational efficiency and premium positioning in the value chain. From 2011 to 2024, EBITDA nearly quadrupled, rising from €38.5 million to €143.3 million, and net profitability improved from negative in 2011 (-4%) to consistently above 5% in recent years. However, the downward shift from a 15.4% EBITDA margin in 2022 to 13.5% in 2024 suggests that maintaining profitability at historical highs may become more challenging without further efficiency gains or pricing adjustments.

R&D Investment

Intercos’s commitment to innovation is evident in the steady increase of R&D expenditure in absolute terms - from roughly €11 million in 2011 to over €40 million in 2024. This growth reflects the company’s ongoing emphasis on proprietary formulations, advanced delivery systems, and sustainable packaging solutions. However, as a percentage of revenues, R&D spend has tapered from over 4.5% in earlier years to around 3.8% in 2024, indicating that while the company invests more in innovation each year, revenue growth is outpacing that investment rate. This relative slowdown could be a strategic choice to leverage scale efficiencies in R&D or a signal that cost discipline is being prioritized in a margin-conscious environment.

By product category, 2024 revenues were led by Makeup (€619.8 million, 58.2% of total), followed by Hair & Body (€278.0 million, 26.1%) and Skincare (€167.1 million, 15.7%). Geographically, EMEA accounted for the largest share (€559.5 million, 52.5%), followed by the Americas (€293.4 million, 27.6%) and Asia (€212.0 million, 19.9%).

Strategic Acquisitions and Global Expansion

Intercos’s impressive growth trajectory is the result of a disciplined, well-executed strategy combining both targeted acquisitions and purposeful expansion of its global manufacturing footprint. This dual approach has enabled the company not only to broaden its capabilities but also to deepen its geographic reach across key markets.

The journey began in 2006 with the acquisition of CRB, a Swiss skincare specialist renowned for its expertise in high-performance and dermatologically advanced formulations. This move anchored Intercos firmly within the skincare arena, benefiting from Switzerland’s longstanding reputation for innovation in dermatology and cosmetics science.

Building on this foundation, Intercos made a transformative acquisition in 2017 with Cosmint Group, an Italian leader in skin, hair, and body care manufacturing. This deal significantly broadened Intercos’s product portfolio and client base, reinforcing its position as one of the world’s largest B2B beauty groups. The same year, Intercos also acquired Drop Nail, strategically enhancing its presence in the fast-growing nail care segment.

A pivotal milestone in Asia came in 2020, when Intercos took full ownership of its Korean joint venture, Intercos Korea, previously a partnership with Shinsegae. This acquisition granted Intercos complete control over a critical hub for K-beauty innovation, providing invaluable regional market intelligence and local manufacturing agility in one of the world’s most dynamic beauty markets.

Alongside these acquisitions, Intercos has systematically expanded its physical infrastructure to support and accelerate growth. In 2021, it established state-of-the-art manufacturing and R&D facilities in Hyderabad, India, strengthening its foothold in the South Asian market. This expansion allows Intercos to tailor formulations to local consumer preferences, including Ayurvedic-inspired and clean beauty products, tapping into the unique demands of this fast-growing region.

Similarly, Intercos has expanded its presence in Latin America with a manufacturing facility in Mexico, positioning itself closer to key clients and enabling more agile service to the Americas. In Europe, a manufacturing expansion in Poland has enhanced production capacity to better serve regional customers. Additionally, the company has upgraded its fragrance production capabilities in Olgiate Comasco, Italy, aligning with the growing market demand for innovative scent solutions.

In the United States, Intercos has strategically enhanced its operational efficiency with a redesigned warehouse in West Nyack, New York, dedicated to cosmetic packaging and storage, and an innovation-focused office, lab, and showroom in Culver City, California-placing Intercos at the heart of West Coast beauty trends and startups.

Together, these acquisitions and facility expansions underscore Intercos’s commitment to a truly global presence, combining cutting-edge innovation with localized expertise. This integrated approach ensures the company remains at the forefront of the beauty industry, delivering tailored solutions that meet the nuanced demands of diverse and evolving markets.

Product Portfolio and Capabilities

Intercos offers end-to-end solutions across the beauty spectrum:

Color Cosmetics: Foundations, concealers, powders, eyeshadows, mascaras, lipsticks, glosses, pencils, and nail lacquers. Its expertise in pigments, textures, and hybrid formats (e.g., skincare-infused makeup) is a key differentiator.

Skincare: Cleansers, moisturizers, serums, masks, sun care, and anti-aging products, many developed through its Swiss R&D arm.

Hair & Body Care: Shampoos, conditioners, treatments, men’s grooming, and fragrance lines - expanded significantly post-Cosmint.

Fragrances: Following recent facility expansions in Italy, Intercos now offers dedicated fragrance development and production capabilities, supporting both personal perfumes and scent components for cosmetics and body care, reinforcing its position as a full-service partner in the beauty industry.

Delivery Systems: A unique strength lies in its in-house design and production of applicators, pens, and smart packaging, including NFC-enabled systems for consumer engagement.

The company operates as a full-service partner, guiding clients from concept and trend forecasting to formulation, regulatory compliance, packaging, and scalable manufacturing. This “360-degree” model fosters deep, long-term partnerships and allows for rapid commercialization - Intercos claims an average product development cycle of 6–9 months, compared to the industry average of 12–18.

Point of Difference: Innovation, Integration, and Sustainability

Intercos’s competitive advantage lies in its industrialized innovation - a rare blend of scientific R&D and operational discipline. The company reinvests approximately 5% of annual revenue into innovation, employing over 900 R&D professionals across 11 global centers. It holds numerous patents, including technologies like Prisma Shine and microencapsulation for time-release actives.

Its vertically integrated model combines formulation, packaging, color matching, and manufacturing - enabling consistency and speed. This is particularly valuable for luxury brands that demand precision and rapid global rollouts.

Sustainability is not a side initiative but a core strategic pillar. Intercos achieved carbon neutrality in Europe in 2022 and aims for 100% renewable energy by 2025. Its Green Lab division focuses on eco-formulations using upcycled ingredients, and it targets 100% recyclable or biodegradable packaging by 2025. The company is a member of the UN Global Compact and has committed to Science Based Targets (SBTi). These efforts resonate with eco-conscious brands and align with tightening global regulations.

SWOT Analysis

Strengths include its global footprint, deep R&D capabilities, diversified client base, and leadership in innovation and sustainability. Its public listing provides access to capital and enhances transparency.

Weaknesses center on operational complexity from managing a vast international network and exposure to client concentration risk - though no single client reportedly accounts for more than 10–15% of revenue.

Opportunities abound in emerging markets (India, Southeast Asia, Middle East), the growing demand for clean and sustainable beauty, and the proliferation of indie and DTC brands that lack in-house manufacturing.

Threats include raw material price volatility, geopolitical supply chain risks, increasing competition from Asian CDMOs like Kolmar and Cosmax, and cybersecurity vulnerabilities - highlighted by the 2024 cyberattack.

Reasons for Success

Intercos’s ascent can be attributed to several interlocking factors:

Visionary Leadership: Dario Ferrari’s original B2B vision and Renato Semerari’s execution of global scaling created a clear, focused strategy.

Relentless Innovation: Its R&D engine drives trend-setting products, from hybrid formulations to smart packaging.

Client-Centric Culture: Operating as a “silent partner,” Intercos maintains high confidentiality and co-develops products closely with brands, earning a Net Promoter Score above 70.

Strategic M&A: Acquisitions were not about size alone but about acquiring specialized capabilities and regional access.

Resilience: The company adapted quickly during the pandemic, shifting production to hygiene and skincare, and recovered from the 2024 cyberattack without derailing growth.

Talent and Culture: With over 40% of managers promoted internally and recognition as a “Top Employer,” Intercos fosters a stable, skilled workforce.

Future Outlook

Looking ahead, Intercos aims to reach $2.5 billion in revenue by 2027, driven by skincare, clean beauty, and digital transformation. Key initiatives include:

AI and Personalization: Using artificial intelligence to develop customized beauty formulations.

Beauty Tech: Exploring wearable devices and smart cosmetics.

Circular Economy: Launching refillable and reusable packaging systems.

DTC Expansion: Scaling Lashify and potentially launching new owned brands.

Emerging Markets: Deepening presence in India, Brazil, and the Middle East.